Mortgage fraud was alleged in 25 cases. In many of those suits, lenders allegedly pressured appraisers to inflate values.

Another big area where mortgage bankers faced litigation was secondary marketing. Many of these cases involved investment bankers attempting to force lenders to buy back loans that had either defaulted early on or involved mortgage fraud. A total of 23 secondary marketing lawsuits were reported.

Mortgage employment cases reported numbered 16. These involved overtime, employment discrimination and employment contracts. Whistleblowers and WARN notice violation cases were also covered.

"With the collapse of the subprime mortgage market and the spillover effect on the rest of the housing market, these are undeniably challenging times," Mitch Kider, managing partner of Weiner Brodsky Sidman Kider PC said. "According to some observers, the litigation spawned by the subprime crisis will be unprecedented."

The report covers 26 types of lawsuits faced by lenders. In addition to an overview of each of the cases, the report includes the plaintiffs, the defendants and the links to the related stories. Some cases also include the court venue, the amount involved and the case title.

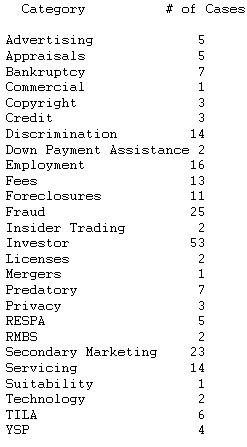

The following table summarizes the number of cases covered in the report by category: