Advertiser Spending

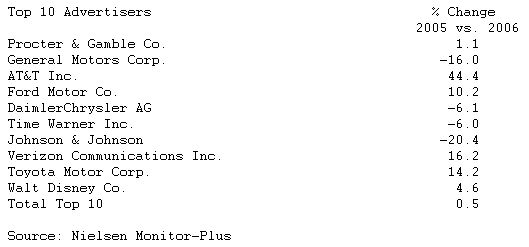

Advertising spending for the top 10 companies of 2006 reached $17.9 billion, remaining essentially flat from 2005, with just 1% growth. Six of the 10 advertisers experienced growth. AT&T and Verizon, both Telephone Services companies, showed the greatest percent growth in terms of percent, at 44.4% and 16.2%, respectively. A portion of this increase is due to merger and acquisition activity, and both companies greatly increased their spending in their Internet Service/Web Access business units.

Offsetting these increases, two of the three automotive advertisers reduced ad spending. Specifically, GM spending was down 16% and DaimlerChrysler decreased its ad spending by 6.1%, while both Ford and Toyota continue to increase spending, and in particular on brands like Toyota Camry and Rav4, Ford Fusion and Mercury Milan.

Johnson & Johnson cut back overall spending on a number of brands including Orthoevra and Ditropan.

Based on spending estimates in the following media: Network TV, Cable TV, Spot TV, Syndicated TV, Hispanic TV, Nat'l/Local Magazine, Network/Spot Radio, Outdoor, Coupons (CPGs only), Nat'l/Local Newspapers (display ads only), Nat'l/Local Sunday Supplements

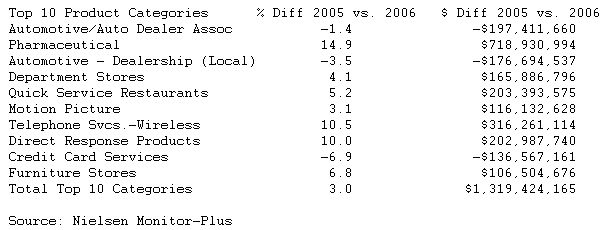

Category Spending

Spending for the 10 largest categories reached $45 billion in 2006, 3% greater than the same period last year. Most product categories have increased spending, with the exception of Credit Card Services (-6.9%), Auto Dealerships (-3.5%), and Automotive, comprised of Factory & Dealer Associations (-1.5%). The Pharmaceutical industry was the fastest growing in terms of percent increase over last year (14.9%) and in terms of actual dollar increase ($719 million). Pfizer increased spending 32% ($158 million), while Merck and Sepracor each increased their budgets 40%, $118 million and $95 million, respectively.

Product Placement

Nielsen's Product Placement Service shows a decrease in the overall number of placements for primetime network programming with a total of 79,701 occurrences for 2006 compared to 102,793 occurrences for 2005. While the total number of occurrences is down, placements that combine an audio and visual mention have increased by 10%. In 2006 there were 4,912 audio/visual combination occurrences compared to 4,456 in 2005.

Top Programs & Brands

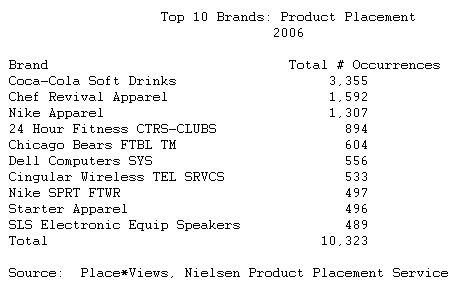

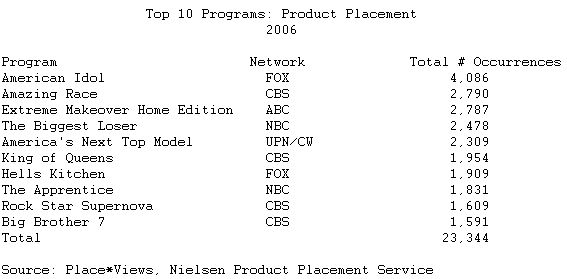

The Top 10 programs that featured product placements for 2006 accounted for 23,344 occurrences. General dramas (22,825 occurrences) replaced situation comedies (19,161 occurrences) as the number one program type to feature brand integrations, due to the airing of more episodes for this type of program in 2006. American Idol featured 4,086 product placements, with more occurrences than any other program, a 17% increase over 2005. The Biggest Loser, not on the top ten list last year, ranked 4th with (2,478) occurrences. The Top 10 brands totaled 10,323 occurrences in 2006, a 13% increase. Coca-Cola was the top brand, with 3,355 occurrences, a 19% increase over 2005. Chef Revival Apparel placed second with 1,592 occurrences.

"The total number of occurrences for product placements decreased in 2006, and can be largely attributed to shifts in programming such as the airing of more dramas, which tend to carry less product placements than other program genres," said Annie Touliatos, Director of Marketing and Strategy for Nielsen Product Placement Service. "However, placements that feature a combination of audio and visuals are rising indicating an increase in planned placements."