L.E.K. Consulting found in April 2010 that households with annual income above $100,000 were more likely than average to have recovered already - or even to have experienced no effects of the recession. The rest expected their household’s finances to recover more quickly than average. Among those earning at least $150,000, the effect was even more pronounced.

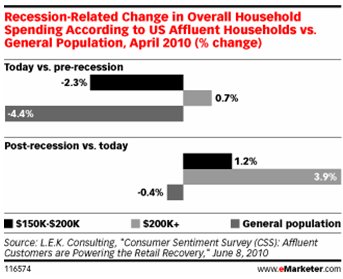

The recession also affected household spending levels less among affluents, L.E.K. reported. While the general population had decreased spending by 4.4% since the onset of the downturn, households making more than $200,000 annually upped spending slightly, by 0.7%. Those highly affluent respondents expected to be spending 3.9% more once the recession was over, compared with flat spending planned by the general population.

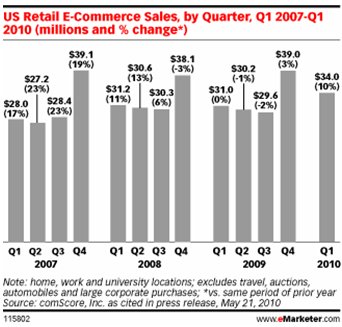

When comScore reported major double-digit grown in US retail e-commerce sales during Q1 2010, the firm attributed much of the upswing to affluent consumers. According to L.E.K., households above the $150,000 mark were 7 percentage points more likely to be “passionate” about online shopping.

“While these spending gains provide reason for optimism, we should note that upper-income households are currently shouldering much of the growth,” said Gian Fulgoni, comScore chairman, in a statement. “Should the economy falter in the second half of the year and upper-income consumers return to a savings mode, we could still see growth decelerate. But for the time being, this momentum is encouraging.”