Not including mortgage debt, the survey revealed that 74% of Americans envision themselves being completely debt free at some point in their lives. Bridget Smith, LendingTree Smart Borrower Center editor-in-chief says, "This is great news but based on what we learned from survey respondents, we're unsure how many will stop being a slave to debt payments and actually make a change to their current lifestyle."

Smith continued, "The survey further uncovered that 50% of Americans confess they are concerned or extremely concerned about the amount of credit card debt they have and surprisingly, 10% chose to declare bankruptcy as the only way to solve their debt problems. These are startling results indicating some borrowers don't seem to know the differences between good debt and bad debt and have little idea how to choose the right path towards financial freedom."

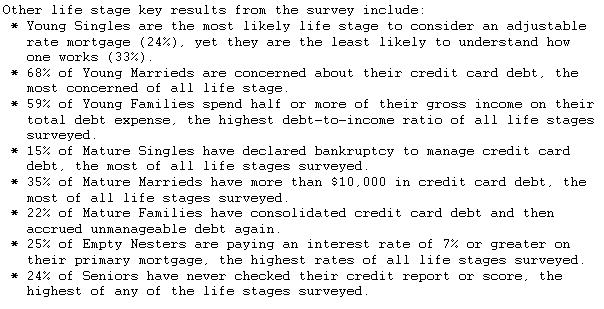

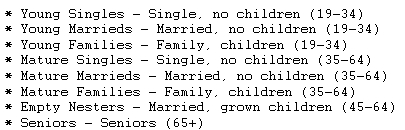

Debt among Life Stages

Peering into the world of debt among Americans, this survey examined the mindset of different life stages as each relates to acquiring and managing debt. The survey also distinguishes different levels of acceptance, tolerance or rejection of debt between generations, and how the mindset of each life stage progresses throughout the various stages of adulthood. In recognition of the particular financial pressures and debt triggers that occur within certain groups, the study examines the following eight different life stages:

A Dissection of Debt among American Young Families:

Young Families, ages 19-34 with children, had the most shocking results of the survey participants. This life stage has the highest debt-to-income ratio (59% spend half or more of their gross income on total debt expense); is admittedly the most uncomfortable with their total household debt (68% are uncomfortable with their debt); and is the least financially prepared should an emergency occur (59% do not have savings available for an emergency).

"Young families struck us as having the biggest debt quandary on their hands," added Smith. "What's really unfortunate is this group is young and they are raising families with debt that they simply do not understand how to manage and this could manifest into a generational pattern."

In addition, Young Families spend the highest percentage of their income on their mortgage (45% spend 35% or more of their gross income); are commonly associated with high credit card debt (62% have more than $3,000 in credit card debt, of which 29% have more than $10,000); and are the least likely life stage to have a financial plan (64% do not currently have a financial plan).