"Positive experiences are a key contributor to advocacy and loyalty, and highly committed customers make more recommendations, use more products and services, and are more likely to positively impact the bottom line for their bank," said Jeff Taylor, senior director of the banking practice at J.D. Power and Associates. "The good news is that financial institutions have been successful in enhancing the banking experience. Customer commitment has improved from 28 percent in 2006 to 31 percent in 2007, and the average number of recommendations customers give for their banks has also increased from seven to nine."

Overall satisfaction with the retail banking experience has increased considerably since 2006 - up by 22 index points on a 1,000-point scale to 763 in 2007. Specifically, customers report higher satisfaction levels with fees, convenience and transaction methods, which include in-person, ATM, online, automated and live phone.

"Customers provided three primary reasons for selecting a bank - good reputation, free services and convenient location," said Taylor. "Reputation, which is supported by recommendations and positive word of mouth, was the reason cited most often for choosing a bank. While many banks have focused on convenience and price, those that provide an outstanding customer experience can enhance their business at a lower cost and will likely achieve long-term sustainable advantages over the competition."

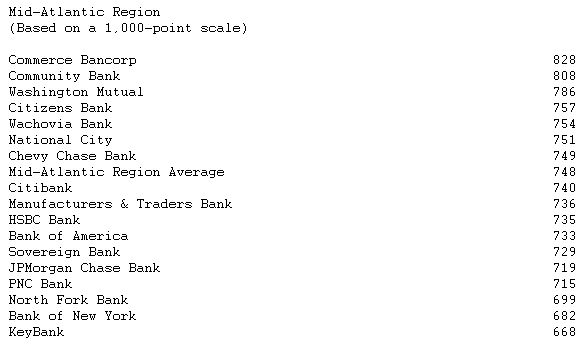

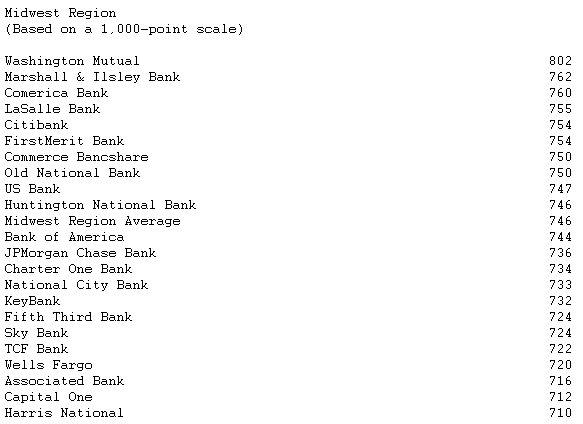

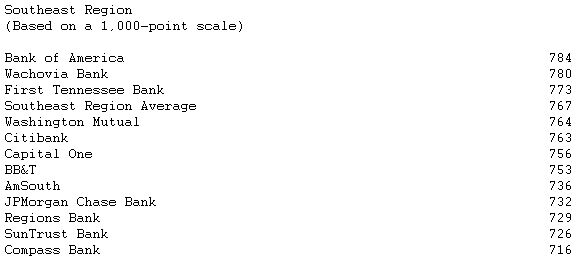

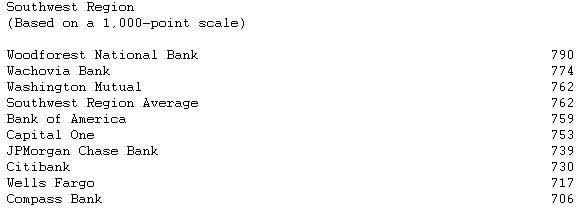

The study analyzes customer satisfaction with the retail banking experience by examining six factors: transactions, account initiation/product offerings, account statements, convenience, fees and problem resolution. Study results by region are:

Mid-Atlantic Region: Commerce Bancorp ranks highest with 828 points, performing particularly well in convenience, account initiation/product offerings, statements and transactions. Community Bank follows with 808 points, while Washington Mutual (786) ranks third in the region.

Midwest Region: With a score of 802 points, Washington Mutual leads the region, receiving high ratings from customers in fees, account initiation/product offerings and statements. Marshall & Ilsley Bank (762) and Comerica Bank (760) follow in the region.

Southeast Region: Bank of America ranks highest with 784 points, receiving favorable ratings in account initiation/product offerings, statements and transactions. Wachovia follows with 780 points and First Tennessee Bank ranks third with 773 points.

Southwest Region: Performing well in all factors that drive overall satisfaction, Woodforest National Bank ranks highest with 790 points. Wachovia Bank (774) and Washington Mutual (762) follow in the region.

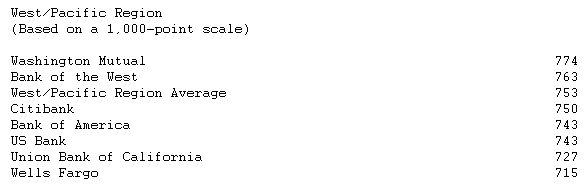

West/Pacific Region: Washington Mutual leads the region with 774 points, while Bank of the West follows with 763 points.

"With nearly 85 percent of customers still doing some of their banking at a branch, regional leaders have done particularly well in offering more convenient hours of operation and branch locations," said Taylor. "While larger banks are certainly making strides in enhancing the retail banking experience, community banks and credit unions are still strong players, as they generally provide shorter in-person transaction times, fewer out-of-service ATMs, and shorter wait and transaction times when customers speak to a live telephone operator. However, community banks and credit unions tend to struggle with convenience, so increasing satisfaction within this area is surely one way for larger banks to remain competitive in the market."

The 2007 Retail Banking Satisfaction Study is based on responses from 20,898 households regarding their experiences with their primary banking provider.

Mid-Atlantic Region includes: Delaware, Maryland, New Jersey, New York and Pennsylvania.

Included in the study but not ranked due to small sample size are: Astoria FS&LA, BB&T, Capital One, First Commonwealth Bank, First Niagara Bank, NBT Bank, New York Community Bank, Northwest Savings Bank, Provident Bank of Maryland, Sky Bank, SunTrust Bank, TD Banknorth, Valley National Bank and Wells Fargo.

Midwest Region includes: Illinois, Indiana, Michigan, Minnesota, Montana, Ohio and Wisconsin.

Included in the study but not ranked due to small sample size are: Chemical Bank, Citizens Banking Corp., First Bank, First Midwest Bank, Flagstar, Guaranty Bank (Midwest), PNC Bank and Regions Bank.

Southeast Region includes: Alabama, Arkansas, Florida, Georgia, Louisiana, Mississippi, North Carolina, South Carolina, Tennessee and Virginia.

Included in the study but not ranked due to small sample size are: Arvest, Bancorpsouth Bank, Carolina First Bank, Chevy Chase Bank, Colonial Bank, First Citizens B&T (Bancorp), First Citizens B&T (Bancshares), HSBC Bank, RBC Centura Bank, Trustmark National Bank, US Bank, Wells Fargo, Whitney National Bank and Woodforest National Bank.

Southwest Region includes: Arizona, New Mexico, Nevada, Oklahoma, Texas and Utah.

Included in the study but not ranked due to small sample size are: Arvest, Bank of the West, Comerica Bank, Frost National Bank, Guaranty Bank (West), International Bank of Commerce, Regions Bank, US Bank, and Zions First National Bank.

West/Pacific Region includes: California, Oregon and Washington.

Included in the study but not ranked due to small sample size are: Capital One, Downey Savings & Loan, KeyBank, Umpqua and World Savings Bank.