TOP PERFORMING INDUSTRIES

The eight industries reporting growth in September - listed in order - are: Health Care & Social Assistance; Retail Trade; Utilities; Transportation & Warehousing; Other Services(d); Public Administration; Wholesale Trade; and Finance & Insurance. The five industries reporting decreased activity from August to September are: Agriculture, Forestry, Fishing & Hunting; Arts, Entertainment & Recreation; Management of Companies & Support Services; Information; and Professional, Scientific & Technical Services.

WHAT RESPONDENTS ARE SAYING …

* “Business activity is flat due to budget concerns by customers globally. New business is limited globally and very price competitive.” (Professional, Scientific & Technical Services)

* “August was a good month. September is holding its own.” (Wholesale Trade)

* “Economic conditions suggest continued caution.” (Educational Services)

* “Appears that we have reached equilibrium. Supply, demand, deliveries, and prices are much more predictable.” (Mining)

* “The market is getting soft with the slow down in the housing market and will continue in the fourth quarter.” (Construction)

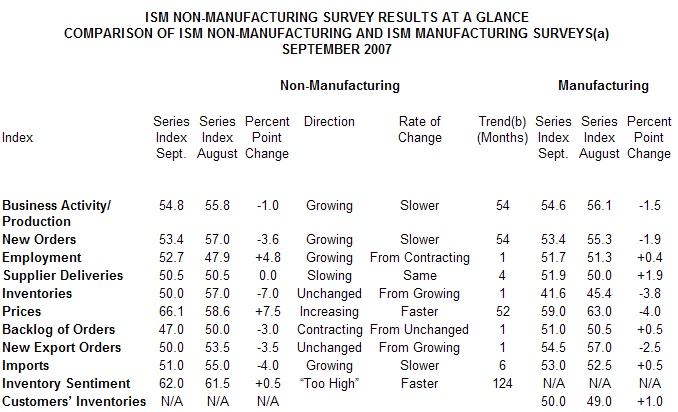

(a) Non-Manufacturing ISM Report On Business® data is seasonally adjusted for Business Activity, New Orders, Prices and Employment. Manufacturing ISM Report On Business® data is seasonally adjusted for New Orders, Production, Employment, Supplier Deliveries and Inventories.

(b) Number of months moving in current direction

COMMODITIES REPORTED UP / DOWN IN PRICE, and IN SHORT SUPPLY

Commodities Up in Price

Airfare (3); Computers and Accessories; Computer Servers; Corrugated Boxes; Envelopes; Fuel (8); Gasoline(c); Hotel Costs (16); Paper (3); Paper Products; Personal Computers; Polyethylene; Printer Toner; Professional Services; Programmers; Pumps; Raw Materials; and Stainless Steel Products.

Commodities Down in Price

Gasoline(c) (4) and Unleaded Gasoline.

Commodities in Short Supply

Construction Contractors is the only commodity listed in short supply.

(c) Reported both Up and Down in price.

SEPTEMBER 2007 NON-MANUFACTURING INDEX SUMMARIES

Business Activity

ISM’s Non-Manufacturing Business Activity Index in September registered 54.8 percent, indicating a slower rate of growth in business activity compared to August. The implication is that non-manufacturing business activity is continuing to increase for the 54th consecutive month. Eight industries reported increased business activity, and five industries reported decreased activity for the month of September.

The industries reporting growth of business activity in September are: Health Care & Social Assistance; Retail Trade; Utilities; Transportation & Warehousing; Other Services(d); Public Administration; Wholesale Trade; and Finance & Insurance. The five industries reporting decreased activity from August to September are: Agriculture, Forestry, Fishing & Hunting; Arts, Entertainment & Recreation; Management of Companies & Support Services; Information; and Professional, Scientific & Technical Services.

New Orders

ISM’s Non-Manufacturing New Orders Index decreased to 53.4 percent in September from the 57 percent registered in August. This indicates continued expansion of new orders but at a slower rate than in August. Comments from members include: “Customers being more conservative; competitive activity” and “Acquired new projects.”

Industries reporting growth of new orders in September are: Health Care & Social Assistance; Retail Trade; Utilities; Transportation & Warehousing; Other Services(d); Construction; Educational Services; and Wholesale Trade. The industries reporting contraction of new orders in September are: Agriculture, Forestry, Fishing & Hunting; Arts, Entertainment & Recreation; Management of Companies & Support Services; Real Estate, Rental & Leasing; Professional, Scientific & Technical Services; and Finance & Insurance.

Employment

Employment activity in the non-manufacturing sector increased in September after one month of contraction. ISM’s Non-Manufacturing Employment Index for September is 52.7 percent, a 4.8 percentage point increase from the 47.9 percent reported in August. Six industries reported increased employment, nine reported a decrease, and three indicated employment is unchanged from August. Comments from respondents include: “Slight increase due to activity levels”; “In preparation of new projects starting”; and “We continue to grow at a double-digit pace - hiring is up to meet that growth.”

The industries reporting growth in employment in September are: Transportation & Warehousing; Retail Trade; Professional, Scientific & Technical Services; Educational Services; Finance & Insurance; and Health Care & Social Assistance. The nine industries reporting a reduction in employment in September are: Real Estate, Rental & Leasing; Arts, Entertainment & Recreation; Other Services(d); Accommodation & Food Services; Utilities; Management of Companies & Support Services; Wholesale Trade; Public Administration; and Information.

Supplier Deliveries

In September, the rate of slowing of supplier deliveries remained the same when compared to August. The index registered 50.5 percent for both September and August. A reading above 50 percent indicates slower deliveries.

The industries reporting slowing in supplier deliveries in September are: Arts, Entertainment & Recreation; Information; Educational Services; Health Care & Social Assistance; Finance & Insurance; and Management of Companies & Support Services. The industries reporting faster supplier deliveries in September are: Transportation & Warehousing; Wholesale Trade; and Public Administration.

Inventories

ISM’s Non-Manufacturing Inventories Index registered 50 percent in September, indicating that inventory levels remained the same as in August. Of the total respondents in September, 30 percent indicated they do not have inventories or do not measure them. Comments from members include: “Backing off of increasing inventory due to lower level of new orders”; “Adjusting to the business level”; and ”Focused effort to reduce.”

The industries reporting increases in inventories in September are: Other Services(d); Retail Trade; Educational Services; Management of Companies & Support Services; Finance & Insurance; and Information. The industries reporting decreases in inventories in September are: Agriculture, Forestry, Fishing & Hunting; Accommodation & Food Services; Arts, Entertainment & Recreation; Transportation & Warehousing; Professional, Scientific & Technical Services; Utilities; Wholesale Trade; and Real Estate, Rental & Leasing.

Prices

Prices paid by non-manufacturing organizations for purchased materials and services increased in September for the 52nd consecutive month. ISM’s Non-Manufacturing Prices Index for September is 66.1 percent, 7.5 percentage points higher than August’s index of 58.6 percent. In September, the percentage of respondents reporting higher prices increased by 7 percentage points to 30 percent as compared to August. The percentage indicating no change remained the same at 68 percent. The percentage of respondents noting lower prices decreased by 7 percentage points in September.

The industries reporting an increase in prices paid in September are: Agriculture, Forestry, Fishing & Hunting; Wholesale Trade; Management of Companies & Support Services; Educational Services; Accommodation & Food Services; Information; Finance & Insurance; Retail Trade; Real Estate, Rental & Leasing; Arts, Entertainment & Recreation; Transportation & Warehousing; Other Services(d); and Public Administration. The one industry reporting a decrease in prices in September is Professional, Scientific & Technical Services.

Backlog of Orders

ISM’s Non-Manufacturing Backlog of Orders Index contracted in September, registering 47 percent, 3 percentage points lower than the 50 percent reported in August. Of the total respondents in September, 41 percent indicated they do not measure backlog of orders.

The industries reporting an increase in order backlogs in September are: Information; Educational Services; Construction; and Retail Trade. The industries reporting lower backlog of orders in September are: Agriculture, Forestry, Fishing & Hunting; Management of Companies & Support Services; Other Services(d); Professional, Scientific & Technical Services; Real Estate, Rental & Leasing; Utilities; Health Care & Social Assistance; Wholesale Trade; Public Administration; and Transportation & Warehousing.

New Export Orders

Orders and requests for services and other non-manufacturing activities to be provided outside of the United States by domestically based personnel in September remained unchanged for the month of September. The New Export Orders Index for September is 50 percent, compared to August’s index of 53.5 percent. Of the total respondents in September, 68 percent indicated they either do not perform, or do not separately measure, orders for work outside of the United States.

The industries reporting an increase in new export orders in September are: Information; Accommodation & Food Services; Wholesale Trade; and Retail Trade. The four industries reporting a decrease in export orders are: Agriculture, Forestry, Fishing & Hunting; Professional, Scientific & Technical Services; Management of Companies & Support Services; and Other Services(d).

Imports

In September, the ISM Non-Manufacturing Imports Index registered 51 percent, 4 percentage points lower than August’s index of 55 percent, indicating that use of imports increased at a slower rate in September when compared to August. In September, 61 percent of respondents reported that they do not use, or do not track, the use of imported materials.

The industries reporting an increase in the use of imports in September are: Information; Accommodation & Food Services; and Retail Trade. The one industry reporting a decrease in imports for the month of September is Wholesale Trade.

Inventory Sentiment

The ISM Non-Manufacturing Inventory Sentiment Index in September registered 62 percent, 0.5 percentage point higher than the 61.5 percent reported in August. This indicates that more non-manufacturing purchasing and supply executives feel discomfort with current levels of inventory in September than in August. In September, 27 percent of respondents felt their inventories were too high, 3 percent indicated their inventories were too low, and 70 percent said that their inventories were about right.

The industries reporting a feeling that their inventories are too high in September are: Wholesale Trade; Other Services(d); Management of Companies & Support Services; Professional, Scientific & Technical Services; Construction; Information; Finance & Insurance; Public Administration; and Retail Trade. The one industry reporting that their inventories are too low is Transportation & Warehousing.