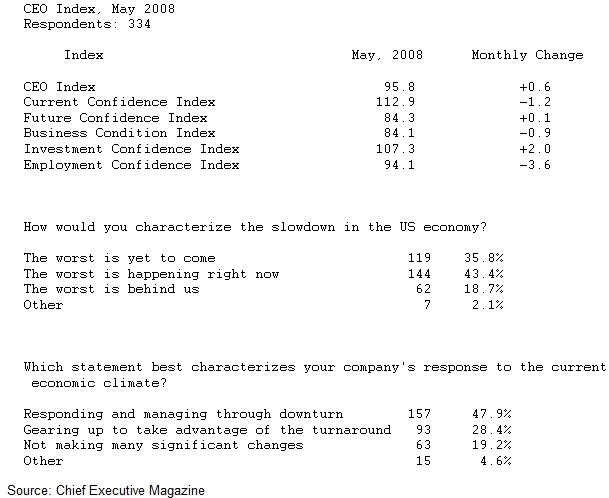

The biggest decline from last month was reflected in the Employment Confidence Index which fell to 94.1 points, a 4 percent decrease. At a closer look, almost half of CEOs (43 percent) say employment will decrease over the next quarter, a stark contrast from only 16 percent who say employment will increase.

The only Indices that made gains were the Future Confidence Index, which rose 15.7 percent to 84.4 points, and the Investment Confidence Index, which rose 2 percent to 107.3 points.

Despite these slight increases, however, CEOs are still uncertain about the current and future investment environment, as over half of respondents (56 percent) say they would describe current conditions as "bad," and 25 percent say they expect the economy to experience a "gradual decline" over the next quarter. "We are avoiding U.S. investment at this time," says Mark Renkert, CEO of Fairhaven Crowne.

Furthermore, most CEOs (43 percent) say they think "the worst is happening right now" and almost half of CEOs (48 percent), say they are "responding and managing through the downturn." Testifying to this trend, John Clymer, President of the Partnership for Prevention, says, "We are seeing dramatic budget cuts by some of our partners and sponsors."

However, it is hard to say that we've hit the bottom. There is still a significant number of CEOs (36 percent) who think the "worst is yet to come." In fact, the ratio between CEOs who believe "the worst is yet to come" versus those who say "the worst is behind us" is nearly 2:1.

"This month's Index continues to reflect the general pessimism among CEOs, who have been clamoring for some time about the structural problems in our economy. The fact that they expect things to get worse before they get better should raise a few eyebrows," says Edward M. Kopko, CEO and Publisher of Chief Executive magazine.