"Since we first measured venture capital's impact on the U.S. economy in 2000, we have seen that venture-backed companies consistently outperform their non-ventured counterparts for job creation and revenue generation across all industries," said Mark Lauritano, managing director of Global Insight's Lending & Payments Practice. "We took three different measurements at three different points in the business cycle with unwavering results. The economic contribution that venture-backed companies make is sustainable and growing."

Some of the nation's best known venture-backed companies include FedEx, Intel, Cisco, Starbucks, Genentech, Google, eBay, Apple and Home Depot.

"Venture capital is an integral and critical component of U.S. economic growth and becoming more so every year," said Mark Heesen, president of the National Venture Capital Association. "Consider the fact that venture investment itself represents just 0.2% of U.S. GDP but venture-backed companies account for nearly 17% of GDP. It is critical that key components of the venture capital ecosystem - support for our capital markets, funding for basic research and development, increases in H-1B visas, and more math and science graduates- remain conducive for fostering this kind of vibrancy," Heesen added.

The study, entitled Venture Impact: The Economic Importance of Venture Capital Backed Companies to the U.S. Economy, was commissioned by the NVCA and conducted by Global Insight, a leading economic analysis and forecasting firm. Global Insight analyzed a database of nearly 23,500 U.S.-based companies that received venture capital financing between 1970 and 2005. From this database, Global Insight measured the employment and revenue contributions of these companies to the national economy. The data was further broken down by industry and by state.

Venture-Backed Companies Outperform Across Industries

When analyzing venture-backed companies by industry, the Global Insight study found that these companies outpaced the annual employment and revenue growth levels of their non-ventured counterparts between 2003 and 2005, contributing significantly to the economic landscapes of their respective industries.

Biotechnology - Venture-backed biotech companies experienced 9.4 percent annual growth in employment from 2003 to 2005 while the gain for the total industry was 3.2 percent during the same period. This translates to nearly 425,000 high-skilled, high-waged jobs contributed by venture-backed companies to the biotechnology and medical devices sectors in 2005. Revenues at these companies totaled nearly $67 billion in 2005 - a compound annual growth rate of 16.4 percent compared to a 9.7 percent growth rate for the entire industry between 2003 and 2005. Additionally, revenues at venture-backed biotech companies accounted for 92 percent of all industry revenues in 2005.

Computers/Peripherals - Venture-backed companies dominate the computers and peripherals industry, accounting for nine out of every ten jobs (1.9 million) in the sector. These companies also expanded their employment at significantly higher rates than the industry average and recorded the largest revenue totals at $466 billion in 2005 - nearly 70 percent of the total industry's revenue generation.

Software - The 2005 employment data show a heavy concentration of venture capital supported jobs in the software industry as well, with nearly 860,000 jobs - almost 90 percent of the total jobs in the sector. Venture-backed companies recorded $210 billion in sales in 2005, which represents more than 36 percent of the industry's total revenues generated that year. Also, between 2003 and 2005, revenue at venture-backed companies jumped by nearly 15 percent annually compared to 13 percent for the total industry during the same time period.

Media/Entertainment/Retail - The largest venture-backed job creators are in the media/entertainment/retail industries, employing more than two million people in 2005 which reflects more than half of the entire industry's employment. Venture-backed companies in this sector contributed nearly $300 billion in sales in 2005.

It is also noteworthy that the financial services industry recorded compound annual employment growth of 10.7 percent, compared with an industry average of only 1.2 percent between 2003 and 2005. Venture-backed companies in the semiconductor, networking and equipment and information technology services sectors were the only three industries that saw net job losses between 2003 and 2005. However, declines in the overall industry were more severe than the aggregate downturn in venture-backed companies.

Venture-backed Companies Contribute to State and National Economies

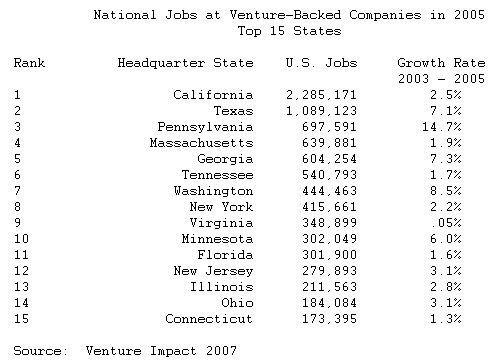

While venture capital investment generates jobs and revenue in every state, there are pockets of the U.S. with strong levels of activity. California, Texas, Pennsylvania, Massachusetts, and Georgia were the states whose venture-backed companies contributed the most national jobs in 2005.

Pennsylvania venture-backed companies added the most US jobs in the 2003- 2005 period at 167,000. Texas companies ranked second, adding 139,400 jobs; California companies added 111,400 jobs across the country, coming in third.

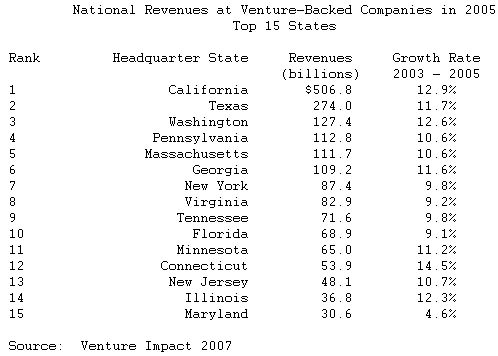

The top five states for venture-backed revenues closely mirror the state employment rankings with one exception: Washington State takes the third position.

The study also found that venture-backed companies in the District of Columbia, with $2.2 billion in 2005 revenues posted the fastest revenue growth in the U.S. with a compound annual growth rate of nearly 25% between 2003 and 2005. Montana, with $462 million was second fastest growing at 20%; and Connecticut at nearly 15%.