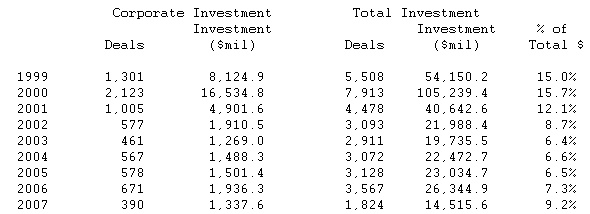

"Despite uncertainty in the US economy, those corporations engaging in venture capital activity are stepping up to the highest levels post-bubble," said Mark Heesen, president of the NVCA. "In doing so, they are supporting some of the most exciting start-ups in their respective industries while providing themselves access to cutting edge innovations. If corporate venture investment continues at this pace, we could see all-time record levels in the near future."

Corporate venture capital is defined as operating corporations investing directly in portfolio companies, either on a sole basis or alongside traditional, independent venture capital funds. These corporate entities are in some cases referred to as strategic investors.

"Corporate venture capital partnerships are vital to a robust global entrepreneurial ecosystem," said Claudia Fan Munce, managing director, IBM Venture Capital Group. "Not only does corporate venture capital offer business and technological expertise to start-ups, through IBM's global ecosystem, these young companies have access to researchers, engineers, developers and most importantly, a channel to a global market of more than 170 countries. This access is critical in giving portfolio companies an advantage in a highly competitive marketplace."

"We are pleased to see that corporate investments and dollars invested are both on the rise," said Arvind Sodhani, president of Intel Capital. "With over $1 billion invested by Intel Capital in 2006, our global experience reflects this trend. Corporate investors are in a unique position to nurture portfolio companies to success while making significant financial returns."

Corporate venture capital, although lower in magnitude than private independent firms, is an excellent barometer of market optimism for this asset class," says Darrell Pinto, director of Global Private Equity at Thomson Financial. "The positive momentum in corporate earnings and corporate M&A levels are complemented by an increasing allocation of corporate dollars to innovation which will likely fuel the continued year-over-year improvement in venture capital disbursements."

In the first half of 2007, investment was heaviest in the Software, Biotechnology and Medical Devices and Equipment sectors. Software accounted for 20% of total investment compared to 14% in the same period of 2006. Biotechnology and Medical Devices and Equipment account for 19% and 15%, respectively.

"Strong investments from these corporations demonstrate a significant trend in terms of a growing reassurance in the marketplace," said Tracy Lefteroff, global managing partner of the venture capital practice at PricewaterhouseCoopers. "These entrepreneurs represent some of the best and brightest thinkers of today and the increased level of funding from corporations is allowing them to continue building intelligent technologies. The future is bright for the progressive companies that are developing our technology of tomorrow."

Corporate investments were heaviest in Expansion and Later Stage companies in the first half of 2007, consistent with 2006 activity.

"The positive development of the corporate venture capital market will help entrepreneurs to implement new businesses. Siemens Venture Capital plays an active role in the growth of its portfolio companies by providing strategic management guidance and access to Siemens' global network of internal and external resources," said Dr. Ralf Schnell, president and CEO Siemens Venture Capital.