The findings from this study, which included data collected from March 5-10, 2008, were compared to results from two previously-published comScore studies conducted from April 3-7, 2007 and March 22-27, 2006. These studies surveyed 1,405 and 2,124 participants, respectively.

"After several years of strong growth in the number of users of online banking services, it appears the market is entering its next phase," said Brian Jurutka, vice president at comScore. "As a result, many of the top banks are realizing that customer servicing is of increasing importance in this competitive market and are therefore investing resources into online service enhancements, as well as mobile banking."

Top 10 Online Banks See Growth Rates Soften Versus Previous Year

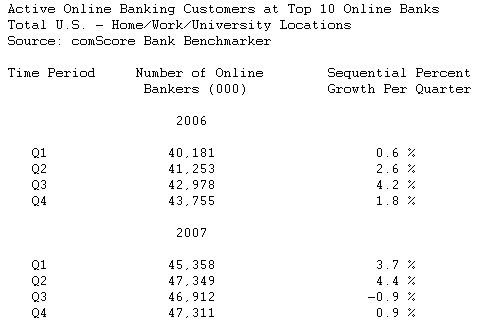

After years of accelerating growth rates, the growth in the number of online banking customers at the top 10 online banks has begun to slow. Specifically, the number of customers who logged into a liquid deposit account (checking, savings, or money market account) at one or more of the top 10 online banks increased to 8.1 percent in the fourth quarter of 2007, compared to a 9.5-percent growth rate the prior year.

Interestingly, from Q2 2007 to Q3 2007, the number of online banking customers who accessed a liquid deposit account declined by nearly 1 percent, which was the first quarterly decrease seen in the industry in the past five years. And, although Q4 2007 saw a 0.9 percent increase in quarterly growth, it was just half the previous year's fourth quarter growth of 1.8 percent.

Customer Satisfaction among Banks Remains High

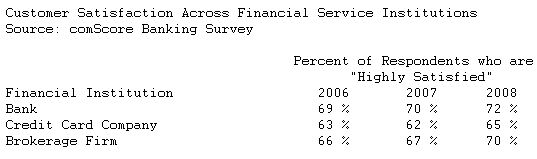

The comScore study also looked at customers' satisfaction with their primary banking institution. Seventy-two percent of survey respondents said they were "highly satisfied" with their primary bank, an increase of two percentage points from 2007 and three percentage points from 2006. Banks consistently lead other financial service institutions such as credit card companies and brokerage firms in this satisfaction rating.

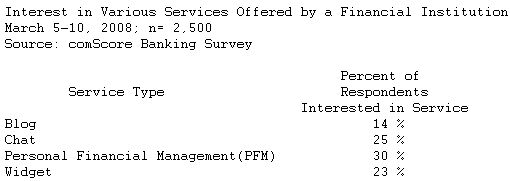

Customers Receptive to Chats and WidgetsOnline banking customers were also surveyed about their interest in various new media services, such as the ability to chat online with a bank representative. Twenty-five percent of respondents said they were interested in a chat capability and 23 percent said they were interested in having a widget from their financial institution that would display their account balance.

"This overall receptivity to chats and widgets in the online banking industry is consistent with general online industry trends. Consumers are increasingly relying on emerging media in many aspects of their online lives, so it's natural that they would want their online banking experience to conform to these expectations," said Jurutka. "However, while consumers express an interest in these features, observed behavioral data shows a much lower adoption rate. This may be due to the fact that many banks have not yet developed capabilities to adequately match consumer expectations, which provides additional opportunities for banks to satisfy their customers."

Additional Study Findings

- Customers who reported being "highly satisfied" with their bank had longer online tenure at the financial institution and were mostly in the younger age group of 24 to 44 years.

- Twenty five percent of survey respondents reported that they were interested in mobile banking, up slightly from last year's 23 percent.

- Consumers interested in mobile banking said they are most interested in obtaining account balance information (61 percent through text message and 57 percent through mobile browser).

- Fifty three percent of respondents said they had at least one of their financial statements delivered in a paperless format

- For customers who have not enrolled in paperless statements, the top two reasons for not doing so were the desire to have a hard copy of the statement for record-keeping (46 percent) and the desire to have a paper bill as a reminder to make a payment (38 percent).