The New York Stock Exchange remained one of the top three exchanges worldwide, raising 11% of global capital and launching two of the top 10 deals for the quarter (American Water and Intrepid Potash - both US-domiciled, as well).

"Many factors - from high market volatility, the slowdown in the world economy, sustained high oil prices and overall uncertainty - all combined to weaken the IPO pipeline for the second quarter," said Maria Pinelli, Americas Director, Strategic Growth Markets, Ernst & Young LLP. "Market performance needs to stabilize for at least a quarter before we hope to see stronger IPO pipeline activity."

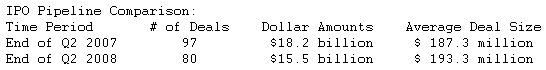

The overall IPO pipeline looks particularly pale in comparison to the market last year at this time.

According to Jackie Brya Kelley, Americas IPO Leader, Ernst & Young LLP, the average amount of time companies wait in the pipeline has nearly doubled over the past year. "On average, IPOs now in the pipeline have remained there for 170 days," said Brya Kelley. "Last year at this time, IPOs waited in the pipeline just 98 days on average."

Technology (22 companies) and biotechnology (13 companies) are still the leading sectors in the current pipeline, though these two industries also represented the most withdrawals. The four asset management companies in the pipeline combined seek to raise the most of any sector with $2.5 billion.

California remained the most active state with 16 filings representing 20% of IPOs in Q2 2008. New York had the highest capital totaling $2.6 billion with only 4 filings, and represented 17% of IPO capital being raised this quarter.