CFOs were asked, "Do you think corporate merger and acquisition activity will increase, decrease or stay the same over the next 12 months?" Their responses:

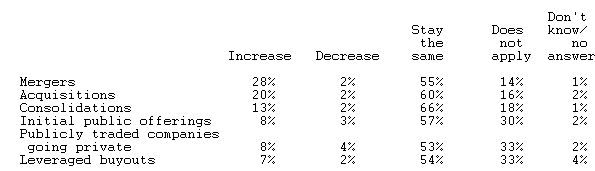

In a related survey, CFOs were asked, "Thinking about your industry, in the next two to three years, do you expect the amount of activity in the following to increase, decrease or stay the same?" Their responses:

Among industries, the greatest amount of merger activity is expected to take place in the transportation and finance sectors in the next two to three years, according to executives polled. Forty-four percent and 42 percent of CFOs, respectively, in these industries said they expect merger activity to increase within the next few years.*

"Relatively low interest rates and deep cash reserves within many companies are prompting firms to make strategic acquisitions," said Paul McDonald, executive director of Robert Half Management Resources. "The complex nature of the merger and acquisition process is driving the need for financial executives knowledgeable in this area. Companies continue to rely on senior financial analysts with specialized M&A experience to support them in conducting due diligence, analyzing financial data, developing competitive forecasts and assisting with tax compliance issues."