"In constructing this survey, we went to the nucleus of the business - senior partners at hedge fund organizations - to get their perspective on what the near-term future will hold," said Russ Prince. "As trusted advisors to the industry for over 20 years, Rothstein Kass was able to offer unparalleled access to these individuals."

Results are based on interviews with the senior hedge fund partners at 301 different hedge funds, each with at least five years of hedge fund experience and assets under management of at least $100 million. Roughly two-thirds of the partners represented firms with between US$100-$750 million in assets, and the remaining third had total assets under management in excess of US$750 million.

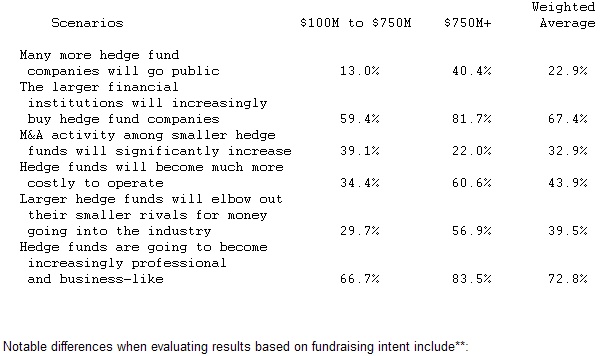

"Hedge funds have grown over the past 15 years to unprecedented proportions, both in number and in assets under management. This sustained growth and financial success have led to an increased interest in the sector by traditional financial institutions, as they look to acquire hedge fund expertise," said Howard Altman, Co-Managing Principal of Rothstein Kass. "Over 67% of the senior partners surveyed, expect increased acquisition of funds by large financial institutions over the next three years and over 80% of the larger firms surveyed were in agreement."

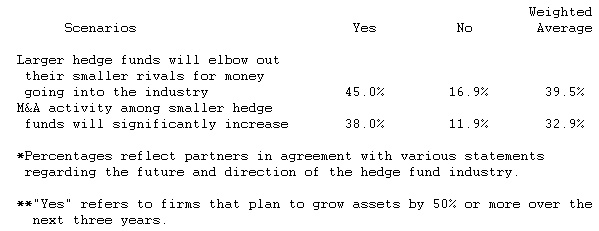

Survey data was analyzed both by firm fundraising intent and assets under management, in order to offer greater insight into broad industry trends. Approximately 80% of the senior partners polled intend to raise 50% or more new assets in the next 36 months. Contrasts were most striking when results were evaluated by firm size, supporting the notion of an industry in transition. Firm size had a dramatic impact on respondents' views on fund raising, capital market transactions and the outlook for consolidation. Highlights include*:

"It was not all that surprising that firm size had a profound impact on how hedge funds viewed the future of the industry, especially in light of the growing institutional focus of larger firms," added Mr. Altman. "To some extent, whether a firm -- regardless of size -- will survive the next wave of consolidation will be determined by its ability to offer investors a clearly defined strategy and greater stability. A major part of these efforts will be to assure investors of the fund's focus on both investment returns and its own internal accounting controls."

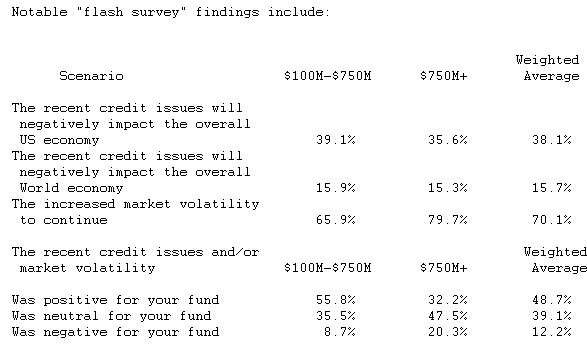

Rothstein Kass also revealed the findings of a Rothstein Kass / Prince Associates "flash survey," on hedge fund managers' view regarding recent market volatility. The survey of 197 hedge fund partners at firms with at least $100 million in assets shows that the majority (70.1%) expects increased market volatility to continue. However, a minority (38.1%) anticipate that recent credit issues will negatively impact the overall U.S. economy, and fewer (15.7%) believe that credit issues will negatively impact the overall world economy. Nearly half (48.7%) reported that recent credit issues and / or market volatility were positive for their fund. Fewer than 13% said that recent volatility was negative for their fund.

"As we were completing our extensive report on hedge fund trends, we elected to again partner with Russ Prince and his team to take the pulse of the industry on continuing market volatility. We also took the opportunity to contrast results against our original data to determine if the market turbulence had substantially altered views on fundraising, M&A or regulatory issues," said Mr. Altman. "Our supplemental research found that recent events had virtually no impact whatsoever on whether hedge funds will go public or be acquired by financial institutions. Fundraising intent also seems unaffected."

Mr. Altman notes, "There was one notable change, however. Only 14% of respondents now expect that it will be more difficult to attract individual affluent investors. This reflects a drop from just over 77% in our industry report. While dramatic, this is not shocking. The hedge fund industry grew from its ability to deliver strong returns independent of market conditions. It's reasonable that hedge funds should expect an inflow of assets from sophisticated investors during periods of market uncertainty."