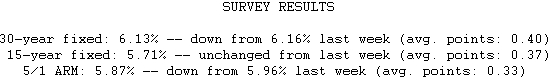

Even though adjustable mortgage rates pulled back this week while fixed rates held steady, the value remains in fixed rate mortgages. The average 30- year fixed mortgage rate is 6.13 percent, compared to the 7/1 ARM at 6.09 percent. That is a negligible difference considering the 30-year fixed rate offers the guarantee that the rate will never change. Borrowers should look for a more substantive difference in the two rates, and even then, the adjustable rate mortgage is best suited for home buyers that don't plan to be in the home when the interest rate resets. Adjustable rate mortgages should not be used as a shortcut to affordability!

Mortgage rates have been on a wild ride since the beginning of the year. The average 30-year fixed mortgage rate was as low as 5.57 percent in January, meaning that a $200,000 loan would have carried a monthly payment of $1,144.38. In February, the average 30-year fixed rate got as high as 6.41 percent, which meant the same $200,000 loan would have carried a monthly payment of $1,252.32. Today, with the average rate at 6.13 percent, a $200,000 loan would mean a monthly payment of $1,215.87.