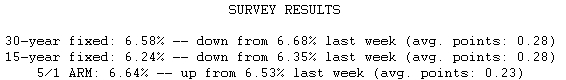

Fixed mortgage rates dropped this week but adjustable rates staged another increase. With rates on most hybrid ARMs such as the 5/1, 7/1, and 10/1 ARM being higher than the average 30-year fixed mortgage rate of 6.58 percent, they hold little appeal for borrowers. Fixed rate mortgages are the place to be, and with the Fed shifting their economic stance notably in the past week, conforming mortgage rates may be headed still lower. As for jumbo mortgage rates, even though the average jumbo rate declined this week, it didn't decline as much as the average conforming rate. The result is a still-wider spread between borrowers on opposite sides of the $417,000 conforming threshold. The spread between the average conforming and jumbo fixed rates is now 0.82 percentage point, up from 0.28 percentage point one month ago.

Despite the turbulence in mortgage markets, fixed mortgage rates are an attractive option for most borrowers. One month ago, the average 30-year fixed mortgage rate was 6.82 percent, meaning that a $200,000 loan would have carried a monthly payment of $1,306.52. Now that the average conforming 30-year fixed rate is 6.58 percent, the same $200,000 loan carries a monthly payment of $1,274.68.