Mortgage rates moved higher after two reports showed inflation could be an issue. In particular, both the Producer Price Index and Consumer Price Index showed larger than expected increases, even after excluding volatile energy costs. The news was enough to push bond yields and mortgage rates higher. After all, inflation is like poison to bond investors as it erodes the value of the fixed payments they receive. Mortgage rates are closely related to yields on long-term government bonds.

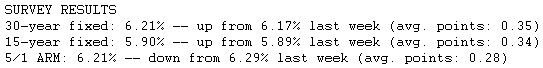

Fixed rate mortgages are currently the most attractive option for borrowers. Five months ago, the average 30-year fixed mortgage rate was 6.82 percent, meaning that a $200,000 loan would have carried a monthly payment of $1,306.52. Now that the average conforming 30-year fixed rate is 6.21 percent, the same $200,000 loan carries a monthly payment of $1,226.24.