Rates for jumbo mortgages, those larger than $417,000, have been increasing as investors command a bigger mark-up for loans that come without any guarantees against default. At a time when conforming fixed mortgage rates have fallen, borrowers in high-cost areas and wealthier borrowers buying bigger homes are seeing much higher rates. The spread between the average conforming and jumbo fixed rates has increased from 0.28 percentage point to 0.69 percentage point in the past two weeks! And add adjustable mortgage rates to the list, with rates on hybrid ARMs jumping this week, some to levels higher than a fixed rate loan. The average 7/1 and 10/1 ARM rates are both higher than the average fixed rate, at 6.67 percent and 6.81 percent, respectively. The place for borrowers to be in today's market is the fixed rate mortgage, especially if they're borrowing less than $417,000.

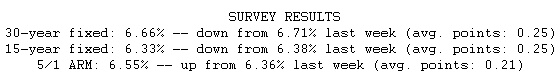

Despite the turbulence in mortgage markets, fixed mortgage rates are an attractive option for most borrowers. Three months ago, the average 30-year fixed mortgage rate was 6.29 percent, meaning that a $200,000 loan would have carried a monthly payment of $1,236.64. Even now, the average conforming 30- year fixed rate is just 6.66 percent, and a $200,000 loan carries a monthly payment of $1,285.25. Fixed mortgage rates still remain the better refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.