Examples of this increase include the Toyota Prius hybrid, which has increased in value nearly $3,800 since January 1, and the Ford Fusion mid-size sedan, which is up a substantial $1,800. As fuel prices continue to rise, Kelley Blue Book expects values for many of these vehicles to continue to increase. However, dealers should be wary of ever-increasing auction values.

Through most of this year, values have been increasing across nearly all segments. Fuel-efficient segments have performed better than others due to the substantial rise in gas prices since the beginning of the year; however, it is safe to say that all used-vehicle values have been very strong through April. While it is obvious to see how high values have climbed since the beginning of the year, it is more difficult to visualize how prices compare today to the past several years. To better quantify this increase, Kelley Blue Book compiled a small list of vehicles to demonstrate the growth in prices.

So far this year, fuel-efficient segments have increased far more aggressively than they have during the past two years. Today, values are up nearly 20 percent since January, a far cry from the steady depreciation of 2009 and 2010. At the segment level, values are up around $1,500-$2,500, with some models surpassing their respective segment average.

Examples of this increase include the Toyota Prius hybrid, which has increased in value nearly $3,800 since January 1, and the Ford Fusion mid-size sedan, which is up a substantial $1,800. As fuel prices continue to rise, Kelley Blue Book expects values for many of these vehicles to continue to increase. However, dealers should be wary of ever-increasing auction values.

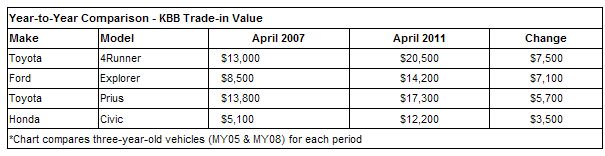

Through most of this year, values have been increasing across nearly all segments. Fuel-efficient segments have performed better than others due to the substantial rise in gas prices since the beginning of the year; however, it is safe to say that all used-vehicle values have been very strong through April. While it is obvious to see how high values have climbed since the beginning of the year, it is more difficult to visualize how prices compare today to the past several years. To better quantify this increase, Kelley Blue Book compiled a small list of vehicles to demonstrate the growth in prices.

Year-to-Year Comparison - KBB Trade-in Value

The chart above illustrates the average change in value for a three-year-old vehicle in April 2007 versus today. It clearly can be seen that values have risen substantially since 2007. This strength in values can be attributed to a sustained lack of supply of used vehicles over the past several years, primarily stemming from reduced new-car sales through the same period. As sales have remained low due to the economic downturn, used-vehicle supplies have been hard-hit, driving prices up over the past several years.

Additionally, with the price of oil currently hovering around $100 a barrel and gas prices approaching $4 per gallon nationally, consumers have flocked to subcompact, compact and hybrid cars in an attempt to reduce the impact of gas prices on the family budget. With families looking to save, purchasing a vehicle with great fuel economy seems like a no-brainer. In response, dealers have been fighting tooth and nail at auction to replenish their inventory with the fuel-efficient vehicles consumers want today.

"Mid-to-late summer, gas prices are expected to decrease and when they do, values for many of these fuel-efficient models are expected to drop" said Alec Gutierrez, manager of vehicle valuation for Kelley Blue Book. "There are multiple ways to look at the market right now and it may not make sense to trade-in your gas-guzzler for a fuel-efficient car because values are so inflated right now; however, if you have an excess vehicle, this might be the best time to sell."