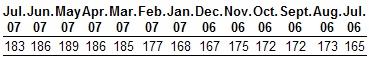

“The Monster Employment Index’s slight decline last month is not surprising as it marks the third consecutive July in which the Index has dipped and clearly suggests the recurring impact of seasonality on overall U.S. recruitment activity,” said Steve Pogorzelski, Executive Vice President, Global Sales and Customer Development at Monster Worldwide. “Despite the drop last month, the Index remains 18 points higher than a year ago and points to a relatively stable U.S. labor market that has continued to exhibit growth, albeit at a slower pace than in 2006,” added Pogorzelski.

Management of Companies and Enterprises; Finance and Insurance; and Public Administration See Strongest Expansion Among Industries in July

Management of companies and enterprises was the industry category that registered the highest rate of increase in online job availability during the month of July. Meanwhile, online opportunities in the finance and insurance industry edged higher. Public administration also saw gains in online job demand for the ninth consecutive month, indicating robust demand in the government sector.

By contrast, goods-producing industries showed signs of continued softness, as both the construction and manufacturing industry categories extended three-month downward trends. Transportation and warehousing also registered fewer online opportunities, but the category remains sharply higher than its year-ago level.

Protective Service and Military Specific Occupational Categories Register Sharpest Monthly Gains

Online recruitment activity for public sector workers rose in July, as demand for occupations in protective service and military-related positions registered the sharpest gains among occupations, while online job availability in the community and social services category, which also contains numerous government jobs, remained steady, bucking the overall downward trend.

Online demand within the major white-collar job categories – management; and business and financial operations – also edged upward over the month, indicating that their declines in June were likely due to a summer seasonal slowdown that simply arrived a bit earlier than expected. Moreover, the improvement in the management category’s year-over-year growth rate also suggests that online recruiting efforts for managers and executives remain elevated amid ever-tight labor market conditions.

Construction-related occupational categories all showed lower online job availability in July, reflecting continued weakness in the U.S. housing sector. The Index’s two healthcare categories also dipped. Nevertheless, healthcare occupations remain the Index’s top growth categories year-over-year after enjoying a strong upward growth trend through the first half of 2007. Categories related to the leisure and hospitality sector also remain high in the Index’s year-over-year rankings, even after a noticeable deceleration in online recruitment activity within the food preparation and serving; and arts, design, entertainment, sports and media categories over the past several months.

Seven of Nine U.S. Census Bureau Regions See Reduced Online Job Availability in July

Among the nine U.S. Census Bureau Regions tracked, New England and West South Central were the best performers, remaining unchanged in July, while the West North Central and Pacific regions registered the sharpest monthly declines. On a year-over-year basis, West South Central, which includes Arkansas, Louisiana, Oklahoma and Texas, remains the Index’s top growth region, while the Pacific region has seen the least improvement.

Thirty-three U.S. states and the District of Columbia registered lower online job demand in July, with California among the states seeing the sharpest decline and contributing to the Pacific region’s weak showing overall. Online recruitment in the Golden State has decelerated in recent months due to less-tight labor market conditions and weaker demand in the construction and finance sectors. Vermont and New Hampshire reported the highest growth rates over the month, while Texas remained the top growth state on a year-over-year basis.