Mortgage rates showed little movement despite a solid jobs report and strong inflation talk from a key member of the Fed. The monthly employment report was enough to stir inflation concerns with stronger-than-expected job growth and a notable pickup in worker compensation. It didn't take long to get proof that inflation remains on the Fed's radar screen as Fed Vice Chairman Donald Kohn noted in a speech that "it is still too early to relax our concerns" about the pace of price increases. The bond market greeted all of this with a shrug, with bond yields and mortgage rates showing little fluctuation during the week. Mortgage rates are closely related to the yields on long-term government bonds.

Fixed mortgage rates are sharply lower since the Fed stopped raising interest rates. Six months ago, the average 30-year fixed mortgage rate was 6.87 percent. At the time, the monthly payment on a loan of $165,000 was $1,083.38. With the average 30-year fixed rate now 6.24 percent, the same loan originated today would carry a monthly payment of $1,014.86. Fixed mortgage rates are a compelling refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.

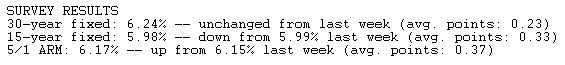

Bankrate's national weekly mortgage survey is conducted each Wednesday from data provided by the top 10 banks and thrifts in the top 10 markets.