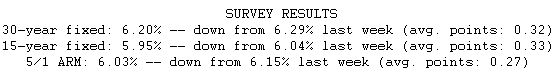

Mortgage rates have been slowly retreating in recent weeks, but the movement accelerated this week with more troubles in the subprime mortgage sector and a sharp one-day drop in the stock market. Both events had investors marching in double-time to the safety of long-term government bonds and the mortgage-backed bonds of prime, or top credit, borrowers. Mortgage rates are closely related to yields on long-term government bonds. The last time mortgage rates were this low, Santa was loading up the sleigh. This week's drop put the average 30-year fixed mortgage rate at the lowest point since Dec. 20.

Fixed mortgage rates are notably lower than last summer when the Fed last raised interest rates. At the time, the average 30-year fixed mortgage rate peaked at 6.93 percent, and a $165,000 loan carried a monthly payment of $1,090.00. With the average 30-year fixed rate now 6.2 percent, the same loan originated today would carry a monthly payment of $1,010.57. Fixed mortgage rates are a compelling refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.