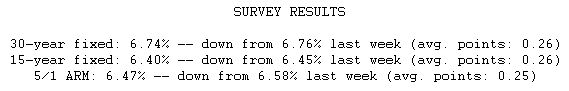

Mortgage rates declined for the second straight week as nervousness about deteriorating conditions in the subprime market sparked a "flight to quality." The mounting delinquencies and foreclosures in the subprime sector and the ensuing debacle among hedge funds that feasted on subprime debt, mean lower rates for many mortgage borrowers. When troubles surface in riskier forms of debt, investors predictably seek shelter in safer havens, such as U.S. Treasury securities or bonds backed by the mortgages of borrowers with strong credit quality. This served to drive bond yields and fixed mortgage rates lower over the past week. Fixed mortgage rates are closely related to yields on long-term government bonds.

Fixed mortgage rates are more than one-half percentage point higher than three months ago. At the time, the average 30-year fixed mortgage rate was 6.22 percent, meaning that a $165,000 loan would have carried a monthly payment of $1,012.72. With the average 30-year fixed rate now 6.74 percent, the same loan originated today would carry a monthly payment of $1,069.09. Fixed mortgage rates still remain the better refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.