Mortgage rates have been on the rise for much of the past two months because of stronger-than-expected economic reports. But this week, it was more good economic news that led mortgage rates to retreat. It began when the Federal Open Market Committee acknowledged improved inflation readings over the past few months at the conclusion of their Jan. 31 meeting. The good news on the inflation front continued with reports on labor costs and the Fed's favored expenditures index also showing improvement. Fewer inflation worries translated to lower bond yields. Mortgage rates are closely related to yields on long-term government bonds.

Fixed mortgage rates are notably lower than last summer when the Fed last raised interest rates. At the time, the average 30-year fixed mortgage rate was 6.93 percent, and a $165,000 loan carried a monthly payment $1,090. With the average 30-year fixed rate now 6.31 percent, the same loan originated today would carry a monthly payment of $1,022.38. Fixed mortgage rates are a compelling refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.

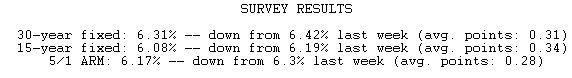

Bankrate's national weekly mortgage survey is conducted each Wednesday from data provided by the top 10 banks and thrifts in the top 10 markets.