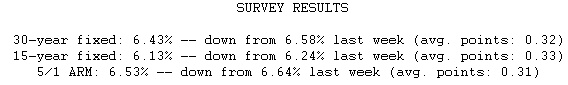

Conforming fixed mortgage rates dropped notably this week on news of more weakness in the housing market and a decline in consumer confidence. The initial interest rates for hybrid ARMs such as the 3/1, 5/1, 7/1, and 10/1 ARMs also declined, but remain higher than those of fixed rate loans. It was a different story on jumbo mortgage loans, where rates remained unchanged and further increased the penalty for borrowers taking loans greater than $417,000. The spread between the average conforming and jumbo fixed rates has exploded from 0.28 percentage point to 0.97 percentage point in the past five weeks.

Amid the turbulence in mortgage markets, fixed mortgage rates are an attractive option for borrowers. Just six weeks ago, the average 30-year fixed mortgage rate was 6.82 percent, meaning that a $200,000 loan would have carried a monthly payment of $1,306.52. Now that the average conforming 30- year fixed rate is 6.43 percent, the same $200,000 loan carries a monthly payment of $1,254.94.