Since peaking five weeks ago, mortgage rates have shown little movement. In fact, the average 30-year fixed rate mortgage has remained in a narrow range of just one-tenth of one percentage point. Despite a calendar chock full of inflation data and Fed Chairman Ben Bernanke's semiannual appearance before Congress, there has been little news to rock the interest rate boat. As a result, the outlook remains that the Fed will be on hold for the foreseeable future and mortgage rates have settled in for the dog days of summer.

Fixed mortgage rates are a little more than one-half percentage point higher than three months ago. At the time, the average 30-year fixed mortgage rate was 6.29 percent, meaning that a $165,000 loan would have carried a monthly payment of $1,020.23. With the average 30-year fixed rate now 6.82 percent, the same loan originated today would carry a monthly payment of $1,077.88. Fixed mortgage rates still remain the better refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.

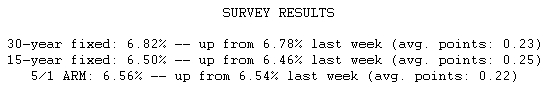

Bankrate's national weekly mortgage survey is conducted each Wednesday from data provided by the top 10 banks and thrifts in the top 10 markets.