Mortgage rates increased following a report about strong consumer spending in November. This was additional evidence, following other reports in recent weeks on retail sales and a strong labor market, that any hopes of a Fed rate cut coming soon are premature. Bond yields and mortgage rates were only slightly higher as there was little else of significance during a holiday- shortened week with light trading volumes. Mortgage rates are closely related to the yields on long-term government bonds.

Fixed mortgage rates are sharply lower since the Fed stopped raising interest rates at mid-year. In late June, the average 30-year fixed mortgage rate was 6.93 percent. At the time, the monthly payment on a loan of $165,000 was $1,090. With the average 30-year fixed rate now 6.23 percent, the same loan originated today would carry a monthly payment of $1,013.79. Fixed mortgage rates are a compelling refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.

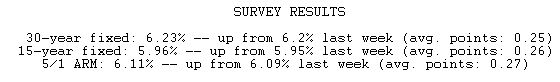

Bankrate's national weekly mortgage survey is conducted each Wednesday from data provided by the top 10 banks and thrifts in the top 10 markets.