Economic data continues to be overwhelmingly positive, a factor behind the increase in mortgage rates over the past half-dozen weeks. More evidence of underlying economic strength piled up this week, with retail sales for December exceeding expectations. The labor market continues to surprise, with weekly unemployment claims falling below the 300,000 mark. All of this has fueled concerns about inflation and delayed any possible Fed rate cut. As a result, investors are commanding higher yields on government and mortgage- backed bonds. Mortgage rates are closely related to the yields on these bonds.

Fixed mortgage rates are still much lower since the Fed stopped raising interest rates. When the Fed last raised interest rates in June 2006, the average 30-year fixed mortgage rate was 6.93 percent. At the time, the monthly payment on a loan of $165,000 was $1,090. With the average 30-year fixed rate now 6.26 percent, the same loan originated today would carry a monthly payment of $1,017.01. Fixed mortgage rates are a compelling refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.

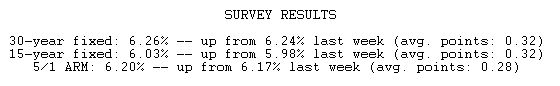

Bankrate's national weekly mortgage survey is conducted each Wednesday from data provided by the top 10 banks and thrifts in the top 10 markets.