Mortgage rates were little changed in the past week despite turbulence in financial markets and concerns about mortgage write downs. Fixed mortgage rates are closely related to yields on long-term government bonds, so typically when bond yields decline, mortgage rates follow suit. That relationship has been disrupted in the past couple weeks as investors place greater emphasis on risk-free Treasury securities and command higher returns on mortgage-backed bonds. This decoupling of government bonds and mortgage rates was evident when bond yields declined but mortgage barely budged.

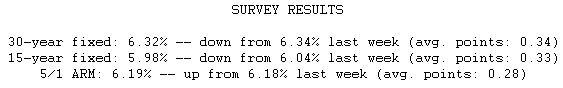

Just three months ago, the average 30-year fixed mortgage rate was 6.68 percent, meaning that a $200,000 loan would have carried a monthly payment of $1,287.90. Now that the average conforming 30-year fixed rate is 6.32 percent, the same $200,000 loan carries a monthly payment of $1,240.55.