Mortgage rates were calm this week as investors awaited the outcome of the Sept. 18 Federal Open Market Committee meeting. Mortgage rates are closely related to yields on long-term government bonds. With the Fed taking many by surprise and cutting short-term interest rates by one-half percentage point, the outlook for fixed mortgage rates is currently unclear. If the Fed's aggressive move indicates an economy that is considerably weaker than originally thought, mortgage rates could move lower. But such an aggressive move by the Fed can open the door to renewed inflation worries in the coming months. If inflation concerns begin to percolate, mortgage rates would move higher. The Fed remains coy about plans for the next meeting Oct. 30-31.

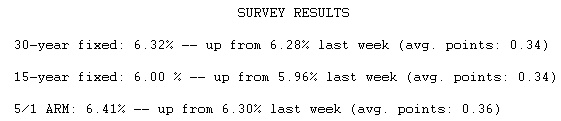

Fixed mortgage rates remain the most attractive option for borrowers. Just two months ago, the average 30-year fixed mortgage rate was 6.82 percent, meaning that a $200,000 loan would have carried a monthly payment of $1,306.52. Now that the average conforming 30-year fixed rate is 6.32 percent, the same $200,000 loan carries a monthly payment of $1,240.55.