A popular misconception is that fixed mortgage rates take their cue from the actions of the Federal Open Market Committee. The past week is evidence that it rarely works that way. After the Fed cut short-term interest rates by a larger-than-expected half percentage point on Sept. 18, concerns about inflation began to percolate. Since inflation is the worst enemy of long-term bond investors, yields on ten-year government bonds moved higher. Fixed mortgage rates are closely related to yields on ten-year Treasury notes, explaining the increase over the past week. The inflation focus of today could quickly give way to economic worries, however, should disappointing data emerge. In all likelihood, this would pull mortgage rates lower. The Fed remains coy about plans for the next meeting Oct. 30-31.

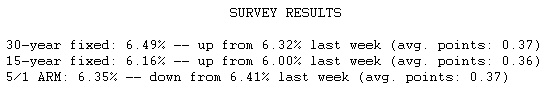

Fixed mortgage rates remain the most attractive option for borrowers. Just two months ago, the average 30-year fixed mortgage rate was 6.75 percent, meaning that a $200,000 loan would have carried a monthly payment of $1,297.20. Now that the average conforming 30-year fixed rate is 6.49 percent, the same $200,000 loan carries a monthly payment of $1,262.82.