2008 ushered in lower mortgage rates, with economic worries rising and mortgage rates falling. Declining new home sales and weaker economic indicators gave investors new reasons to worry about the economy. Such worries typically prompt investors to park money in safe havens such as Treasury securities. Fixed mortgage rates are closely related to yields on long-term government bonds. With four weeks and an entire cycle of economic data before the next scheduled meeting of the Federal Open Market Committee, sentiment about the direction of interest rates and the economy may swing back and forth as worries alternate between economic growth and the outlook for inflation.

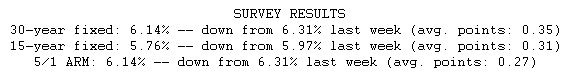

Fixed rate mortgages are currently the most attractive option for borrowers. Five months ago, the average 30-year fixed mortgage rate was 6.71 percent, meaning that a $200,000 loan would have carried a monthly payment of $1,291.88. Now that the average conforming 30-year fixed rate is 6.14 percent, the same $200,000 loan carries a monthly payment of $1,217.16.