Mortgage rates often show short spurts of volatility and prolonged periods of little movement. We've seen both instances play out thus far in 2007. Mortgage rates had been confined to a narrow range of approximately one-third of a percentage point for nearly seven months - including weeks on end with virtually no movement. But they broke out of that range with this week's move, as hopes for a Fed interest rate cut continue to wane. With several prominent economic releases on tap in the coming days, bond traders have sold positions ahead of time, pushing bond yields and mortgage rates upward. Mortgage rates are closely related to yields on long-term government bonds.

Fixed mortgage rates have increased nearly one-third percentage point since mid-March. At the time, the average 30-year fixed mortgage rate dipped to 6.16 percent, meaning that a $165,000 loan would have carried a monthly payment of $1,006.30. With the average 30-year fixed rate now 6.47 percent, the same loan originated today would carry a monthly payment of $1,039.66. Fixed mortgage rates still remain a compelling refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.

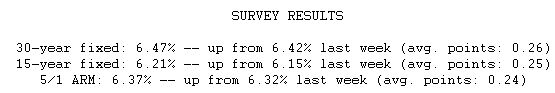

Bankrate's national weekly mortgage survey is conducted each Wednesday from data provided by the top 10 banks and thrifts in the top 10 markets.