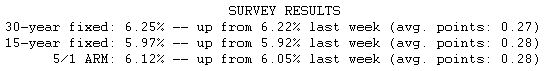

Mortgage rates nudged higher, but only slightly so, for the third consecutive week and are still stuck within the same narrow range they've been in for most of the year. The economy hasn't shown enough signs of either strength or weakness to give rates a hard shove in either direction. This week, unease over Iran probably had a hand in pushing rates upward a bit. Thursday's jobless report has a better chance of making them move strongly.

Fixed mortgage rates are notably lower than last summer when the Fed last raised interest rates. At the time, the average 30-year fixed mortgage rate peaked at 6.93 percent, and a $165,000 loan carried a monthly payment of $1,090.00. With the average 30-year fixed rate now 6.25 percent, the same loan originated today would carry a monthly payment of $1015.93. Fixed mortgage rates are a compelling refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.