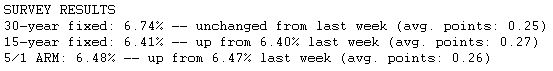

Although yields on Treasury notes declined below the 5 percent barrier this week, mortgage rates showed little movement. Fixed mortgage rates are closely related to yields on long-term government bonds. Lighter trading volumes in financial markets, brought on by the mid-week July 4 holiday, can lead to quirks such as a decline in benchmark bond yields that doesn't carry through to mortgage rates. With more economic data looming in the next week, mortgage rates may awaken from the brief siesta.

Fixed mortgage rates are roughly one-half percentage point higher than three months ago. At the time, the average 30-year fixed mortgage rate was 6.25 percent, meaning that a $165,000 loan would have carried a monthly payment of $1,015.93. With the average 30-year fixed rate now 6.74 percent, the same loan originated today would carry a monthly payment of $1,069.09. Fixed mortgage rates still remain the better refinancing alternative for adjustable rate borrowers facing sharp payment adjustments.