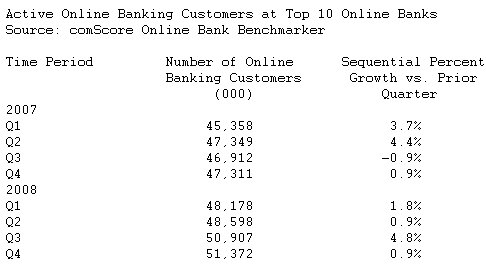

Top Online Banks Continue Growth in Customer Acquisition in 2008

After several years of particularly strong growth in the use of online banking at the top 10 banks, the second half of 2007 showed the first signs of softness as sequential quarterly growth rates fell below 1 percent, but then recovered somewhat in 2008 as banks became more aggressive in their online banking customer acquisition efforts.

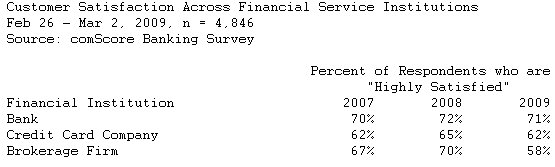

Banking and Credit Card Customer Satisfaction Withstands Recession

When asked about their satisfaction with their primary financial institutions, the percentage of respondents indicating that they were highly satisfied with their banks (down 1 percent) and credit card issuers (down 3 percent) declined only marginally versus 2008 and were at least as high as the levels seen in 2007. The decline was more pronounced, however, among brokerage firms, which saw their highly satisfied customers decline from 70 percent of respondents in 2008 to 58 percent in 2009.

"Given the performance of the financial markets in the past year, it's not surprising that brokerage customers with declining balances would not be as satisfied as last year," said Marc Trudeau, comScore senior director. "It's interesting that a negative halo effect was not seen with respect to banks and credit card issuers, perhaps because of the reliability of services and the outreach they provided during a time of financial strain for many customers."

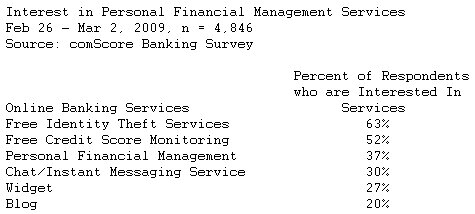

Online Financial Tools Represent Customer Opportunity for Banks

Online banking customers were also asked about their interest in various online tools to help manage their finances. More than 60 percent expressed interest in free identity theft services, while free credit score monitoring appealed to 52 percent. Approximately 37 percent of respondents showed a strong interest in online personal financial management tools, with half of those interested indicating they were willing to pay a modest monthly fee for the services.

"That customers are asking for more services to help them manage their personal finances during these economically-challenging times is a positive sign for banks," added Trudeau. "It's clear that most customers are paying close attention to their personal finances, and, consequently, for the banks that step up and provide customers with the tools they're requesting, it's an opportunity to both cultivate and solidify customer relationships and to potentially drive incremental revenue as well."