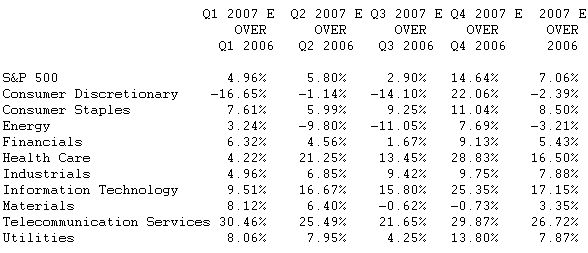

"Due in part to a slowing U.S. economy and the pullback in home construction and remodeling, the earnings slowdown that began at the end of 2006 is building up steam," says Howard Silverblatt, Senior Index Analyst at Standard & Poor's. "Standard & Poor's Equity Research Services expects a 5.8% gain for the second quarter of 2007 and a 2.9% gain for the third, which is partially due to the difficult comparisons with 2006."

"We believe slowing earnings momentum and a lack of visibility surrounding the timing of future Fed easings are likely to prevent meaningful equity market upside over the near term," says Sam Stovall, Chief Investment Strategist of Standard & Poor's Equity Research Services. "Since December 29, 2006, Standard & Poor's equity analysts' first-quarter growth estimates have fallen from 8.2% to the current 5.0%, with six of the 10 sectors experiencing downward revisions in excess of 20%. Only the financials and consumer discretionary sectors saw upward adjustments."

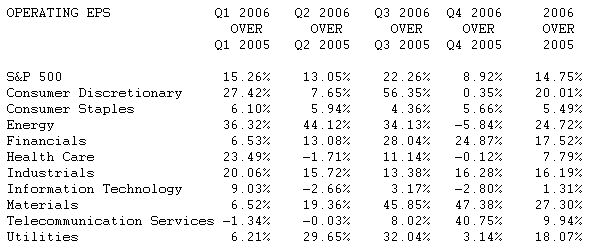

Standard & Poor's notes the record streak of 18 consecutive quarters of double-digit earnings gains for the S&P 500 ended in the third quarter of 2006. However, the expected 2007 single-digit gain still represents a potential new high for both operating and as-reported earnings.

Even though first-quarter earnings have continued the current trend of slowing growth, the S&P Investment Policy Committee believes attractive market valuations and an anticipated economic recovery in 2008 will allow the S&P 500 to reach 1510 by year-end, a 6.5% increase from 2006.