The May 2009 study by the Credit Research Foundation (CRF) found that a growing number of companies have been forced to shift their focus from driving revenue and gaining market share to cash flow and profitability. More than 61% of businesses surveyed said their top priority is to expedite accounts receivable turnover to accelerate cash flow. As banks and other financial institutions continue to reduce Lines of Credit (LOC), shorten maturities and raise rates regardless of where companies fall in the credit spectrum, cash flow has become the leading concern for funding operations through 2009. As a result, more companies are relying on receivables financing which is becoming a mainstream funding source to improve liquidity, as evidenced by recent data from the Liquidity Desk of The Receivables Exchange.

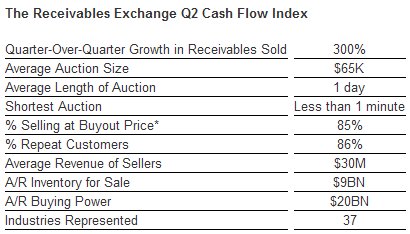

The Receivables Exchange, the world's first online auction marketplace for real-time trading of accounts receivable, has seen an exponential increase in quarter-over-quarter trading volume as more businesses adopt receivables financing as a new standard in working capital management.

* Sellers have the option to specify a “Buyout Price,” which if bid by a single Buyer, will result in the instantaneous awarding of the auction, thereby closing all further bidding.

“Small and mid-sized businesses are the engine that drive this economy,” said Justin Brownhill, co-founder and chief executive officer of The Receivables Exchange. “Unfortunately, now more than ever they have fewer places to turn to fund their day-to-day operations. With nearly 60% of their working capital tied up in outstanding invoices, most companies can benefit from releasing the “cash” power of their receivables.”

A May 2009 study of U.S. businesses by the Credit Research Foundation reveals the struggle businesses continue to face as a result of tightening credit.

* 88% report that the economy has had a direct negative effect on their business, up from 77% in November 2008

* 70% report that they are experiencing a slow down in customer payments, up from 67% in November 2008

* 45% say the financial crisis is straining their availability of working capital, up from 33% in November 2008

* 82% say their customers are experiencing tightening of bank financing, up from 68% in November 2008

* 66% report that they have tightened collections of accounts receivable, down slightly from 68% in November 2008

Benefits of accounts receivables financing through The Receivables Exchange:

* Increased Liquidity - Access to cash in as little as 24 hours rather than the current 50+ day payables process to fund operations

* Complete Financing Control - Sellers set all auction parameters. If a bid does not meet the Seller’s parameters, the Seller is not required to sell

* Lower Cost of Capital - Competitive real-time bidding by multiple Buyers drives down the cost of capital

* Less Restrictive – No personal guarantee; traditional lending institutions have restrictive covenants and liens on collateral, which can limit a business’s spend flexibility

* Key Financial Benefits – Decrease Days Sales Outstanding (DSO), increase liquidity ratios, enhance ROE

Every day more businesses are turning to The Receivables Exchange to increase liquidity. The Exchange provides a flexible and efficient capital marketplace for small and mid-sized businesses to finance growth and optimize their working capital management. Learn more about how to improve cash flow and finance accounts receivables.