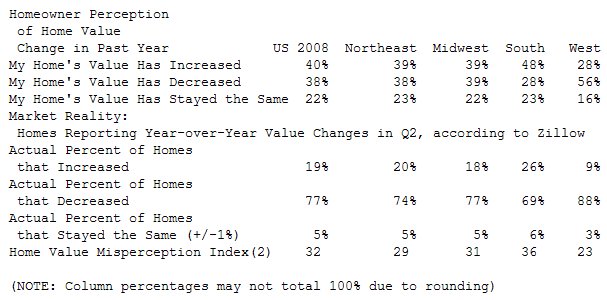

Seventy-seven percent of U.S. homes lost value in the past 12 months, according to preliminary analysis of Zillow's Q2 Real Estate Market Reports, due to be released August 12, while only 19 percent increased and 5 percent remained the same. Whether it's apathy, confusion or just plain denial, homeowners seem to believe the housing crisis affects every other home but "not my house," underscoring a wide gap between homeowners'inflated perception of their home values and the gloomy market reality.

To monitor this perception-reality gap over time, Zillow has created the Home Value Misperception Index, which is the difference between the adjusted percentage of homeowners who believe their home value increased over the past year and the adjusted percentage of homes that have increased in value. Nationwide, the Q2 Home Value Misperception Index is 32, reflecting this broad gap. Those in the West, which has the highest proportion of homes (88%) that declined in value during the quarter, seem to have the best grasp on reality with a Misperception Index of 23, while those in the South have the widest gap at 36.

More Optimism for Own Home vs. Neighbors' Homes in the Short-Term:

Homeowner short-term outlook is even more optimistic than current perception as three out of four (75%) homeowners expect their home value will increase or stay the same over the next six months, with 25 percent expecting a decline. The same level of optimism doesn't extend to neighboring homes, however, as 42 percent expect values in their local market to drop and 58 percent think values will increase or remain the same.

More Foreclosures Expected Yet Half Oppose Government Bailout for Those Facing Foreclosure:

Four in five homeowners (82%) expect to see more or about the same amount of foreclosures in the next six months as they did in the last six. Already, more than nine out of 10 (92%) of all homeowners say there have been foreclosures in their local real estate market. Of these, 70 percent are at least somewhat concerned that foreclosures will decrease home values in their local market within the next year. Despite these concerns, nearly half of all homeowners (48%) say homeowners who are currently facing foreclosure because they took out an adjustable rate mortgage or other loan that they can no longer afford should not receive government assistance to stay in their homes. Only 28 percent support government intervention and 24 percent "don't know."

Two-thirds (64%) of Homeowners Planning Home-Investment Activities in Next Six Months:

- 56% are planning major (e.g. replace the roof, remodel the kitchen) and/or minor (e.g. install new garbage disposal, repaint or wallpaper a room) home improvements, with 17 percent planning major improvements and 49 percent planning minor ones. Of interest is how the perceived change in home value can impact home investment plans. Homeowners who believe their home has increased in value are significantly more likely to plan major home improvements (22%) than those who believe their home's value has decreased (14%).

- 7% are planning home financing activity [refinance their mortgage (5%), take out a home equity line (2%), or take out a second mortgage (1%)]

- 7% are planning to buy or sell a primary or secondary residence [sell their home (5%); buy a new primary or secondary residence (4%)]

"Our survey reveals a wide gap between the perception homeowners have about their own home's value and the realities of a market in which three-quarters of homes declined in value in the past year. We attribute this gap to a combination of inattention and a fair bit of denial that causes people to believe their home is insulated from the woes of the market that affect others, but not them," said Dr. Stan Humphries, Zillow vice president of data and analytics. "This sentiment is also carried through in homeowner confidence for the short-term as more people expect their home to perform better in the next six months than the market and recent past. Although many homeowners may believe the worst is over, we think this level of optimism is out of sync with actual market performance."