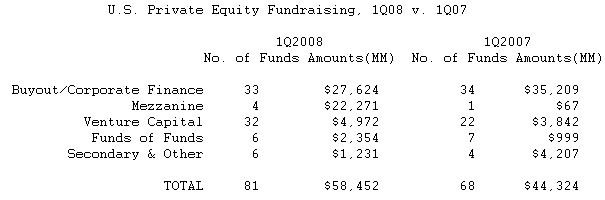

Correspondingly, leveraged buyout (LBO) fund-raising fell 22% to $27.6 billion raised by 33 funds in the first quarter from $35.2 billion raised by 34 funds a year ago. While a number of large buyout funds are in the market, it is now taking them longer to close their funds.

"These figures aren't really too surprising," said Jennifer Rossa, managing editor of Dow Jones Private Equity Analyst. "The shakeup in the credit markets has slowed the pace of buyout deals. That's making it harder for large firms like Blackstone Group to justify raising big new funds."

Other private equity strategies that are less dependent on the credit markets did better. Venture capital funds in particular saw a big increase in activity in the first quarter of 2008 with 32 funds closed, 10 more than last year. They also raised 29% more capital compared to the first quarter of 2007 with just under $5 billion.

"With the big buyout funds no longer taking up all the attention of private equity investors, other strategies like venture and mezzanine are gaining ground," said Ms. Rossa.

According to the newsletter, WL Ross & Co. LLC closed the largest buyout fund of the first quarter with its $4 billion WLR Recovery Fund IV LP, which is focused on distressed debt opportunities. The largest venture capital fund belonged to Essex Woodlands Health Ventures, which raised $800 million for its Essex Woodlands Health Ventures VIII LP fund.

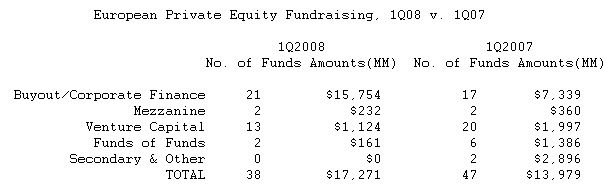

Number of European Funds Drops, Investment Rises 24%

European private equity firms also saw an upswing in investment in the first quarter of 2008 with nearly $17.3 billion invested in 38 funds, a 24% increase over the nearly $14 billion invested in 47 funds over the same period last year.

Most of the increase in European buyout fund-raising came from one big fund, Bain Capital's new European fund, which closed at roughly $4.8 billion during the first quarter.

Ms. Rossa added: "European buyout fund-raising numbers also got a boost from several funds targeting Eastern Europe and Russia, where opportunities for buyouts are still seen as strong."