“Hundreds of thousands of more homeowners won’t be able to escape foreclosure for most of the rest of the year either unless stagnating housing prices and markets pick up, and the nation’s economy rebounds, too,” says Alexis McGee, president of ForeclosureS.com and author of the upcoming book, “The ForeclosureS.com Guide to Investing: Making Huge Profits Investing in Pre-Foreclosures Without Selling Your Soul” (John Wiley, September 2007).

“All the congressional, industry, and media talk about helping financially strapped homeowners work out their default woes has had little effect on the current foreclosure picture. Instead, foreclosure numbers keep rising; the effects of the sub-prime lender debacle have spilled over into other mortgage markets like Alt-A (those borrowers that aren’t prime, but have better than sub-prime credit histories); and some analysts even predict the increased tightening of lending practices may actually have a detrimental affect on homeownership overall.

Just like a pendulum, lending standards swung too far out “getting everyone into a mortgage, whether they could afford it or not” to “tightened lending standards that are preventing qualified buyers from homeownership. At some point, the pendulum will need to rest in the middle, with lending standards easing from where they are now -- and the sooner the better,” adds McGee.

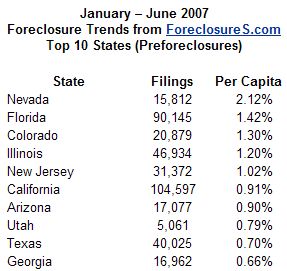

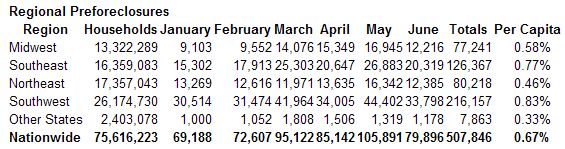

The first six months pre-foreclosure filing numbers are also grim. These are the homeowners who have defaulted on their mortgages but haven’t yet lost their homes to foreclosure. Nationally, nearly 7 out of every 1,000 households (more than 507,000) were forced to deal with the threat of foreclosures year to date.

Every region of the country saw their numbers of pre-foreclosure filings increase in the second quarter over the first quarter of the year 2007, too.

“We base our foreclosure statistics on the formal notices filed against a property in the foreclosure process,” says McGee. “In some states that can mean up to three filings against one property — notice of default, notice of foreclosure auction, and notice of REO (after a property has gone to foreclosure auction and a bank or lender takes possession of a property). In other states, it’s only two filings — auction notice and REO notice.

“If you simply count the foreclosure filings, the same property will be counted multiple times, which inaccurately skews the numbers,” says McGee. “To avoid that confusion we now report the type of filings broken down into just two groups — pre-foreclosures (the initial notice that can be default OR auction, but not both) and REOs (after foreclosure, now lender owned).”

This provides a clearer picture of the actual number of homeowners facing potential foreclosure, and trying to work out their financial problems — pre-foreclosures — from those homeowners that failed to solve their default problems, and lost their homes to foreclosure, and now REO (real estate owned by a bank or lender). Let’s take a closer look:

* The Southwest Region remains hardest hit by pre-foreclosure filings with just over 8 (8.3) pre-foreclosure filings for every 1,000 households. Nevada, with 21.2 filings per its 1,000 households, leads the region. Colorado takes the No. 2 spot in the region with 13 filings per 1,000. Followed by California with 9.1 filings per 1,000, and Arizona with 9.0 filings per 1,000.

* The Southeast Region takes second nationally in pre-foreclosures with 7.8 filings per 1,000 households. Florida leads with 14.2 pre-foreclosure filings in the first six months of the year. Arkansas and Georgia both recorded more than 6 filings per 1,000 households.

* Some of the counties nationwide with the highest number of per capita pre-foreclosure filings so far this year include: Kendall, IL (32.1 per 1,000), Wasatch, UT (31.0 per 1,000), Valencia, NM (30.4 per 1,000), Lee, FL (29.1 per 1,000), Flagler, FL (27.7 per 1,000), Adams, CO (27.5 per 1,000), Clark, NV (26.9 per 1,000), Pinal, AZ (26.8 per 1,000), Osceola, FL (25.6 per 1,000), Riverside, CA (25.4 per 1,000).

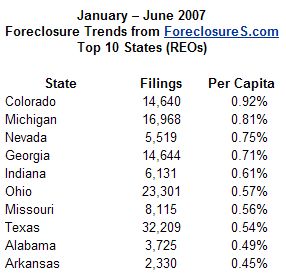

* Looking at REO’s (those people that actually lost their homes to foreclosure) Colorado has had 9.2 REO filings for every 1,000 households. But that’s down from the 23.8 filings per 1,000 households in the state for all of 2006.

* Michigan ranked second with 8.1 REO filings out of every 1,000 households. That’s down from the 11.5 filings per capita for every 1,000 households for all of 2006.

* Nevada ranked third with 7.5 filings for its every 1,000 households. That’s up slightly from the 7.2 filings per 1,000 for all of 2006.

Other states with big numbers of homeowners per capita lost to REO foreclosure include: Georgia (7.1 filings per 1,000); Indiana (6.1 per 1,000); Ohio (5.7 filings per 1,000); Missouri (5.6 filings per 1,000) and Texas (5.4 filings per 1,000).

* Counties hard-hit nationwide by REOs so far this year include: Mohave, AZ (33.8 filings per 1,000); Hood, TX (30.4 filings per 1,000); Elko, NV (29.5 per 1,000); Weld, CO (28.2 per 1,000); Modoc, CA (23.3 per 1,000); Garland, AR (19.6 per 1,000); Park, CO (18.0 per 1,000); Elbert, CO (17.0 per 1,000); Adams, CO (16.6 per 1,000); Hardeman, TN (15.8 per 1,000).

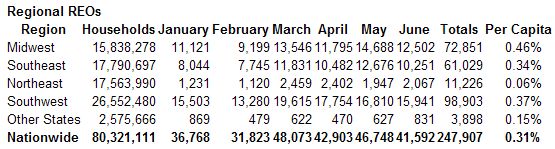

“The REO filings also show that the Midwest Region continues to take the brunt of the foreclosure epidemic nationally in terms of properties actually lost to foreclosure so far this year — 4.6 REO filings per 1,000 households,” says McGee. “That’s being fueled by a combination of manufacturing slowdowns, offshore outsourcing, and economic fallout from depressed markets and home prices.” The Midwest also led in REO filings per capita for all of 2006 (8.1 per 1,000 households).

So far in 2007, the Southwest ranks second with 3.7 REO filings per capita, with the Southeast trailing closely with 3.4 filings per its 1,000 households. The REO outlook, though, continues to brighten in the Northeast with less than one (0.6) REO filings year to date per 1,000 households.

With this surge in foreclosures, the use of REO auctions is growing, too. That’s when a lender, bank, or group of property holders contracts with a private auction company to sell their REO properties in a large scale event. “It’s a great thing for the lenders, as these auction companies are filling the room with a ton of buyers and selling their properties for top dollar in one weekend,” says McGee. “However, that is not good news for the buyers at these auctions. Too many potential homeowners and investors are misled into thinking they’re going to get a great deal at auction,” says McGee.

“That’s not necessarily the case. In fact, the reality instead is that often if it’s a big, well-publicized auction — as in the case of the 400-plus property auctions that draw 4,000 bidders — buyers end up paying as much (if not more) for a property than what is currently listed for sale in their MLS. That’s what’s been happening with most properties at big auction events earlier this year. It’s a function of supply and demand. You get 10 people bidding on a house, and watch the prices skyrocket.”