The release of two prominent inflation barometers pushed mortgage rates higher this week. The release of the Producer Price Index on Tuesday and the Consumer Price Index on Wednesday fueled concerns about an upward creep in prices. Bond yields, and mortgage rates, increased in response. Inflation is the worst enemy of an investor in a fixed income instrument such as a mortgage-backed bond as it erodes the value of the payments received.

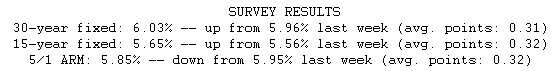

Mortgage rates have been on a wild ride since the beginning of the year. The average 30-year fixed mortgage rate was as low as 5.57 percent in January, meaning that a $200,000 loan would have carried a monthly payment of $1,144.38. In February, the average 30-year fixed rate got as high as 6.41 percent, which meant the same $200,000 loan would have carried a monthly payment of $1,252.32. Today, with the average rate at 6.03 percent, a $200,000 loan would mean a monthly payment of $1,202.96.