There has been remarkably little movement in the 30-year fixed over the last month, especially when compared to what's been happening to U.S. Treasuries. In the last month, the 30-year fixed has remained in a tight range between 6.34 percent and 6.29 percent. Meanwhile, the yield on the 10-year Treasury has fallen almost half a percentage point. Mortgage rates and Treasury yields usually move in the same direction, but not always. Mortgage rates aren't joining Treasuries on their plunge because of the perception of risk. Treasury notes are safe because they are backed by the U.S. government. But there is risk to owning securities backed by residential mortgages. Investors account for that risk by keeping mortgage rates steady, even as Treasury yields fall.

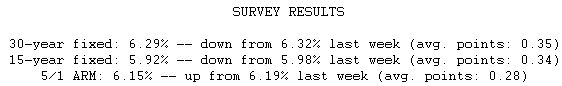

Just three months ago, the average 30-year fixed mortgage rate was 6.58 percent, meaning that a $200,000 loan would have carried a monthly payment of $1274.68. Now that the average conforming 30-year fixed rate is 6.29 percent, the same $200,000 loan carries a monthly payment of $1236.64.