Mortgage rates plunged following last Friday's lackluster employment report. Poor job growth figures raised concerns about economic health and helped push mortgage rates to the lowest point since May 2. Mortgage rates are closely related to yields on long-term government bonds. Nervousness about the economy often drives investors toward the safe haven of Treasury securities, pushing both bond yields and mortgage rates lower. Rates for jumbo mortgages - those above $417,000 - declined by a similar amount, settling at 7.2 percent. While the spread between jumbo and conforming mortgage rates remains uncharacteristically wide, this spread has stabilized in the past two weeks.

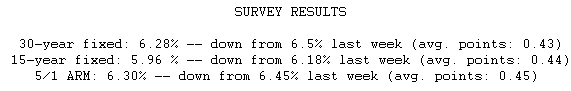

Amid the turbulence in mortgage markets, fixed mortgage rates are an attractive option for borrowers. Just two months ago, the average 30-year fixed mortgage rate was 6.82 percent, meaning that a $200,000 loan would have carried a monthly payment of $1,306.52. Now that the average conforming 30- year fixed rate is 6.28 percent, the same $200,000 loan carries a monthly payment of $1,235.34.