Another drop in pending home sales added to mounting housing concerns and helped pull mortgage rates lower. Worries about the economic fallout from housing enticed investors into the safety and security of long-term government bonds. Fixed mortgage rates are closely related to yields on ten-year Treasury notes. The path of mortgage rates in the next week is very likely to hinge on the outcome of the employment report to be released Oct. 5. If job growth does not appear as bad as initially thought, this could give the Federal Open Market Committee latitude to pause at the next meeting. But more troubling signs from the job market might compel the Fed to cut interest rates again. The Fed remains coy about plans for the Oct. 30-31 meeting.

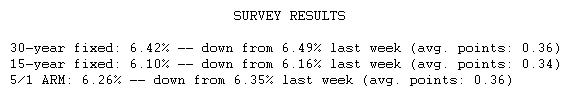

Fixed mortgage rates remain the most attractive option for borrowers. Just three months ago, the average 30-year fixed mortgage rate was 6.74 percent, meaning that a $200,000 loan would have carried a monthly payment of $1,295.87. Now that the average conforming 30-year fixed rate is 6.42 percent, the same $200,000 loan carries a monthly payment of $1,253.63.