The turmoil that was so prevalent in credit markets earlier in the year has given way to smoother waters in recent weeks. Accordingly, fixed mortgage rates have been comparatively placid in contrast to the wild gyrations seen during the first quarter. Mortgage rates are closely related to yields on long-term government bonds. Short of a crisis in the credit markets, the Federal Reserve is expected to hold off from further interest rate cuts. But mortgage rates could still be volatile in the weeks ahead. Additional signs of economic weakness, such as another poor employment report for April, would likely push mortgage rates down. Inflation is a risk as well, and could propel rates higher in the weeks ahead.

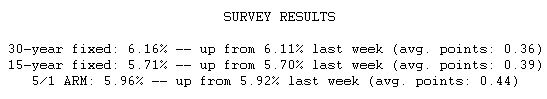

Mortgage rates have been on a wild ride since the beginning of the year. The average 30-year fixed mortgage rate was as low as 5.57 percent in January, meaning that a $200,000 loan would have carried a monthly payment of $1,144.38. In February, the average 30-year fixed rate got as high as 6.41 percent, which meant the same $200,000 loan would have carried a monthly payment of $1,252.32. Today, with the average rate at 6.16 percent, a $200,000 loan would mean a monthly payment of $1,219.75.