Mortgage rates were higher over the last week due to persistent concerns about inflation, as oil prices approached $120 per barrel, and hopes that the housing market is bottoming. Bond yields, to which mortgage rates are closely related, moved up in response. With another interest rate cut expected from the Federal Reserve at their meeting next week and a full economic calendar into early May, mortgage rates could be volatile. Further signs of economic weakness would likely push mortgage rates down, but inflation could propel rates higher.

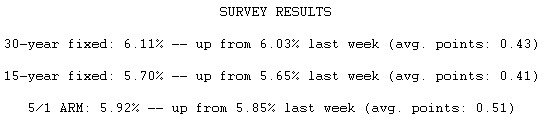

Mortgage rates have been on a wild ride since the beginning of the year. The average 30-year fixed mortgage rate was as low as 5.57 percent in January, meaning that a $200,000 loan would have carried a monthly payment of $1,144.38. In February, the average 30-year fixed rate got as high as 6.41 percent, which meant the same $200,000 loan would have carried a monthly payment of $1,252.32. Today, with the average rate at 6.11 percent, a $200,000 loan would mean a monthly payment of $1,213.28.