"The improvement is very good news for GM," says John W. Henke, Jr., Ph.D., president and CEO, of Planning Perspectives, Inc., which conducts the annual study. "In late 2005, Bo Andersson (GM's Group Vice President, Global Purchasing and Supply Chain) announced a GM program to improve relations with its suppliers. It is now apparent that the program is working. In fact, in the 15 years we've been doing studies of this type in the automotive and other industries worldwide, we have never seen such a dramatic improvement.

"On the other hand, Ford announced a similar program about the same time as GM, but our study shows the Ford program has been a disappointing failure. This is unfortunate because Ford more than ever is dependent on the support of its suppliers to help in its turn around, as was Chrysler in early 1990s. A key to Chrysler's success then was building strong relations with suppliers on its way to a decade of strong profits."

Nevertheless, both companies are far behind Toyota and Honda, which rank 1 and 2, respectively, on the study's Working Relations Index (WRI). Nissan is ranked number 3, with DCX number 4, and GM and Ford are ranked 5 and 6, respectively.

The WRI rates these six major North American OEMs in 17 key areas that impact their supplier working relations. These include such things as degree of trust, open and honest communication, amount of help given to suppliers to reduce costs and the supplier's profit opportunity at the OEM.

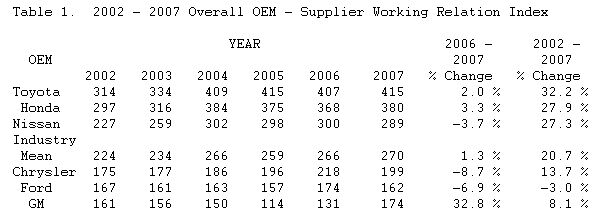

Of the six automakers, the domestic OEMs have been on the bottom half of the scale with GM the lowest - except this year - since the WRI's inception in 2002 (see Table 1). The foreign domestic automakers have continually been on the top half with Toyota having the highest rating, followed closely by Honda.

This year Ford ranks at the bottom of the six North American OEMs with a ranking of 162, a 12 point drop from last year. GM moved up to 174 from 131, and Chrysler fell to 199 from 218 after a steady four-year gain. Chrysler's drop is corroborated by a decrease of 50% in the number of suppliers who consider DCX a "most preferred or very preferred" OEM to work with. Nearly 50% of Ford's suppliers would rather not work with Ford or are ambivalent about doing so.

The Working Relations Index (WRI) ranks OEMs' supplier working relations based on 17 criteria across five (5) areas: OEM-Supplier Relationship, OEM Communication, OEM Help, OEM Hindrance, and Supplier Profit Opportunity. WRI scores can range from zero to 500, with 500 indicating the best supplier relations. A WRI ranking of zero to 249 indicates very poor to poor supplier working relations; 250-349 indicates adequate relations; and 350-500 indicates good to very good supplier working relations.

According to the study, the principal reason for the improved supplier working relations at General Motors is significantly improved relations with its largest suppliers. GM went from a WRI of 87 in 2005 to 247 this year with its largest suppliers. GM's largest suppliers now have the best working relations of all suppliers to the domestic OEMs. Ford's largest suppliers, on the other hand, have poorer relations today then they did two years ago before the new program began.

Nissan, although well ahead of Chrysler, is also slipping. Its WRI dropped to 289 this year from 300 last year, due primarily to a drop in the areas of help provided suppliers, communications with suppliers, and supplier profit opportunities. Toyota and Honda continue to improve very slightly. Toyota moved up to 415 from 407 and continues to have the best working relations in the industry, while Honda improved to 380 from 368. Honda's improvement is primarily due to an increase in trust of its largest suppliers, which dropped last year.

In spite of the slight changes seen with Toyota and Honda, their supplier working relations have remained essentially constant for the past four years. The lack of substantial improvement in their supplier relations over the past four years suggests it may be time for both companies to re-evaluate how they are working with suppliers with the intent being further improvement in their supplier relations. Such an effort could play a key role in each company's continued success, says Henke.

Working Relations Variations Within and Across OEM Purchasing Groups

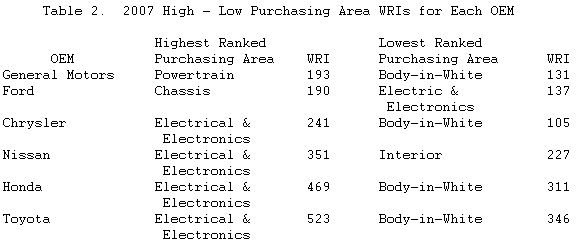

In addition to ranking supplier working relations on an overall basis, the study measures how suppliers rank working relations for six major purchasing areas within each OEM. What is significant is that the WRI for each purchasing area varies considerably within and across each OEM (see Table 2).

At GM, for instance, which has an overall WRI ranking of 174, working relations in the powertrain area is ranked highest at 193, while the body-in- white area is rank at a low 131 (a significant improvement over 2006 when the BIW area was ranked at 74). All other GM purchasing groups fall in between.

Toyota, with an overall WRI of 415, has a very high electrical and electronics area WRI of 523 - a substantial increase over last year, while its body-in-white area WRI decreased to 346 from 381 in 2006.

Among the six automakers, Toyota's electrical and electronics area has the best supplier working relations in the industry of any OEM purchasing area, and GM's body-in-white group has the worst relations.

"Supplier working relations within each OEM vary among the various purchasing areas, indicating that it is the OEM personnel who have the day-to- day responsibility of working with suppliers who are the primary determinants of the company's supplier relations. This indicates the importance of having performance metrics in place to drive the desired behavior of these individuals," said Henke.

"While GM has shown some small gains overall, it has a long way to go to reach the level of Honda and Toyota. Even to continue improving its supplier working relations, it's going to take a real commitment on the part of GM's purchasing management team to keep things going in the right direction and continue the improvements suppliers experienced this past year. This will include having the right performance metrics for purchasing personnel in place."

Unintended Consequences: Disinvestment in Domestic OEMs

According to Henke, the WRI rankings means much more to the OEMs than winning or losing a popularity contest. Poor supplier relations can have serious long-term consequences.

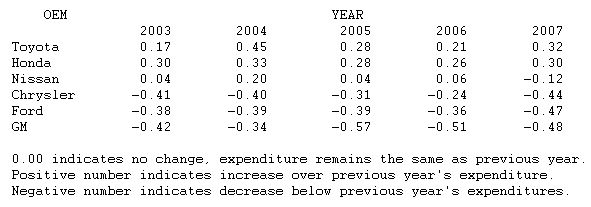

"One of the more significant consequences to automakers with poor supplier relations is that suppliers tell us they are investing less research and development dollars in future programs for these OEMs, while also reducing service and support. In fact, for the past five years, suppliers to the domestic OEMs have actually cut their R&D expenditures for the domestic automakers while increasing R&D funding for the foreign domestic automakers, particularly Toyota and Honda, with whom they have better relations."

Since 2002 when Henke started tracking supplier investments, the study shows suppliers have continually decreased investment in the domestic OEMs in terms of R&D expenditures (see Figure 1) as well as in service and support, while increasing those dollars marginally for Nissan. However, suppliers have invested in Honda and Toyota by about the same amount they have reduced each of the domestic OEMs.