IPO Activity Overview

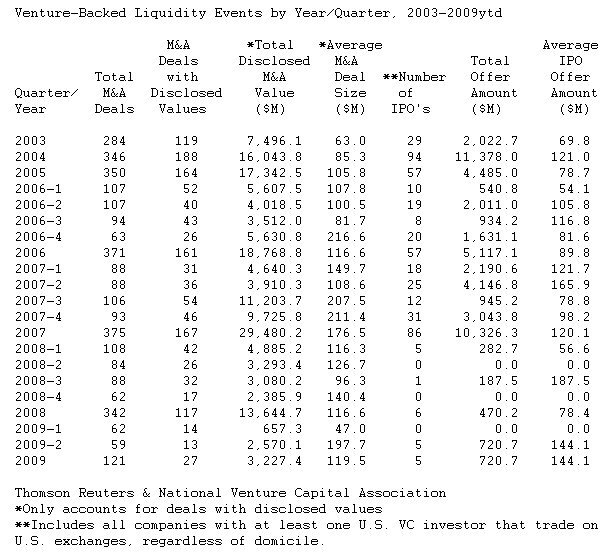

There were five venture-backed IPOs valued at $720.7 million in the second quarter of 2009, the most offerings since the first quarter of 2008 (also five) and the highest dollar volume since the fourth quarter of 2007 ($3.0 billion).

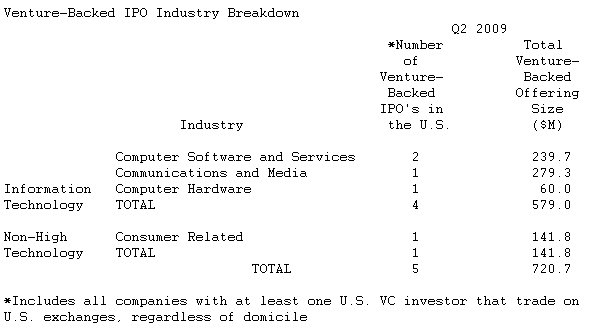

Four of the five IPO exits for the quarter were in the information technology sector, accounting for $579.0 million. Within this sector, computer software and services companies garnered the most deals, with two, while the largest dollar volume was associated with the communications and media related-transaction worth $279.3 million. There was one non-high technology deal by a consumer related venture-backed company for $141.8 million.

The largest transactions of the quarter were a $279.3 million issue from Colorado-based earth imaging company DigitalGlobe in May followed by a $151.5 million offering from Texas-based network management company SolarWinds in the same month.

In addition to domestic activity, there was one offering by a US venture-backed company on a foreign exchange in the second quarter. California-based information retrieval services company Array Networks went public on the Taiwan stock exchange in May.

Of the five IPOs in the second quarter, all were trading at or above their offering prices as of 6/30/2009. Only ten venture-backed companies are currently filed for an initial public offering with the SEC.

Mergers and Acquisitions Overview

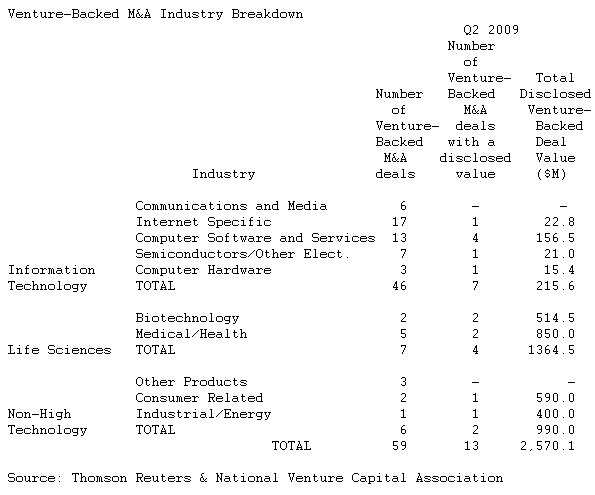

As of June 30, 2009, 59 venture-backed M&A deals were reported for the first quarter, 13 of which had an aggregate deal value of $2.6 billion. The average disclosed deal value was $197.7 million, the highest level since the fourth quarter of 2007.

The information technology sector led the venture-backed M&A landscape, with 46 deals and a disclosed total dollar value of $215.6 million. Within this sector, internet specific and computer software and services companies accounted for the bulk of the targets, with 17 and 13 transactions, respectively, across these sector subsets. Life sciences saw the next highest level of activity with seven deals and a combined disclosed value of $1.4 billion. Finally, non-high technology deals accounted for six exits with $990.0 million in disclosed values.

The largest transaction of the quarter was the acquisition of surgical instrumentation and equipment provider Corevalve by Medtronic, also a medical equipment concern, for $700 million.

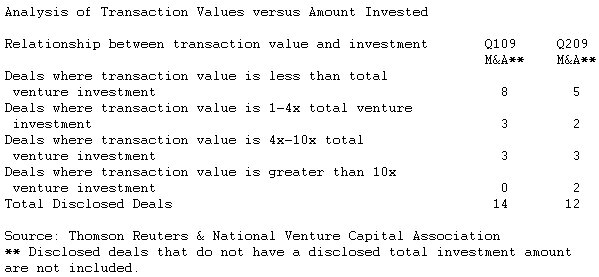

Deals bringing in the top returns, those with disclosed values greater than four times the venture investment, accounted for 42 percent of the total in the second quarter of 2009, significantly better than in the first quarter of 2009 when these deals accounted for 21 percent. Those deals returning less than the amount invested also accounted for 42 percent of the quarter's total, compared to 57 percent of the total in the previous quarter.

"The improved quality of acquisitions was driven by a number of favorable deals in the second quarter; we are hopeful this will continue," said Heesen. "We would like to see the volume of acquisitions rise over the next several quarters to realign with historical norms. Hopefully, the improved stability in the market in the last month should send a signal to corporate acquirers that now is the time to ramp up their acquisition activity."